For the 24 hours to 23:00 GMT, the USD rose 0.36% against the JPY and closed at 115.24.

In the Asian session, at GMT0400, the pair is trading at 115.19, with the USD trading a tad lower against the JPY from yesterday’s close.

Data released overnight revealed that Japan’s Tankan large manufacturing index advanced to a level of 10.0 in 4Q 2016, in line with market expectations and hitting its highest level since December 2015. In the prior quarter, the Tankan large manufacturing index had registered a reading of 6.0. Meanwhile, the nation’s Tankan non-manufacturing index remained unchanged at a level of 18.0 in the fourth quarter of 2016, confounding market expectations of a rise to a level of 19.0.

Early morning data indicated that the nation’s final industrial production remained flat on a monthly basis in October, following a rise of 0.1% in the preliminary print and compared to an advanced of 0.6% in the prior month.

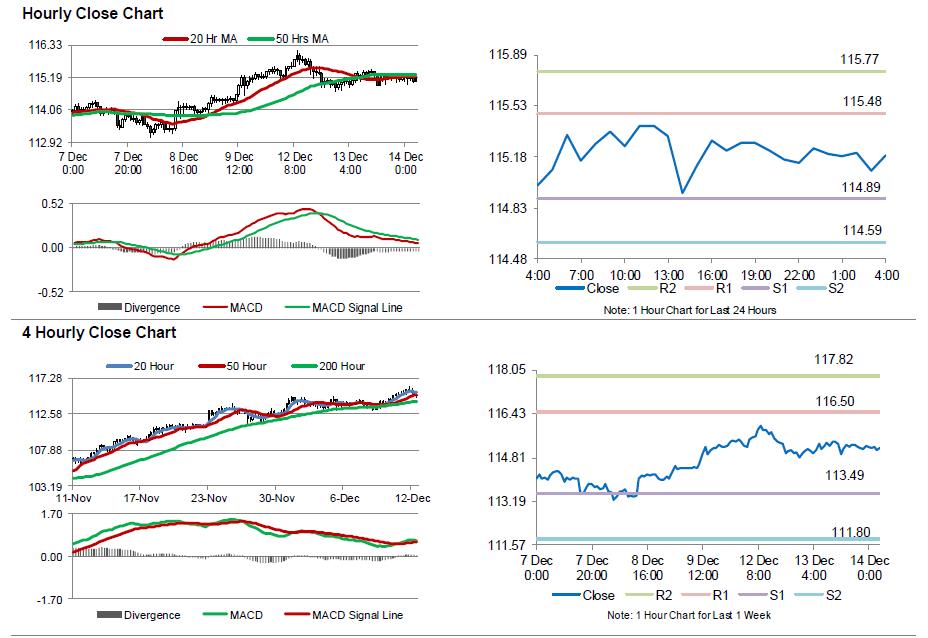

The pair is expected to find support at 114.89, and a fall through could take it to the next support level of 114.59. The pair is expected to find its first resistance at 115.48, and a rise through could take it to the next resistance level of 115.77.

Moving ahead, investors would focus on Japan’s flash Nikkei manufacturing PMI, due to release overnight.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.