For the 24 hours to 23:00 GMT, the USD declined 0.52% against the JPY and closed at 104.70 on Friday.

In the Asian session, at GMT0400, the pair is trading at 104.77, with the USD trading 0.07% higher against the JPY from Friday’s close.

Overnight data showed that, Japan’s flash industrial production unexpectedly remained flat on a monthly basis in September, raising doubts over the nation’s manufacturing sector. Markets expected industrial production to advance by 0.9%, compared to a rise of 1.3% in the prior month. Additionally, the nation’s retail trade surprisingly remained flat on a monthly basis in September, adding to evidence that private consumption would continue to act as a drag on the nation’s economic growth. Retail sales recorded a revised fall of 1.2% in the prior month whereas markets anticipated for a gain of 0.2%. Further, the nation’s large retailers’ sales eased by 3.2% MoM in September, surpassing investor consensus for a drop of 2.7% and compared to a decline of 3.6% in the previous month. On the contrary, housing starts advanced more-than-expected by 10.0% on an annual basis in September, against market expectations for an advance of 5.2%. In the prior month, housing starts had increased by 2.5%.

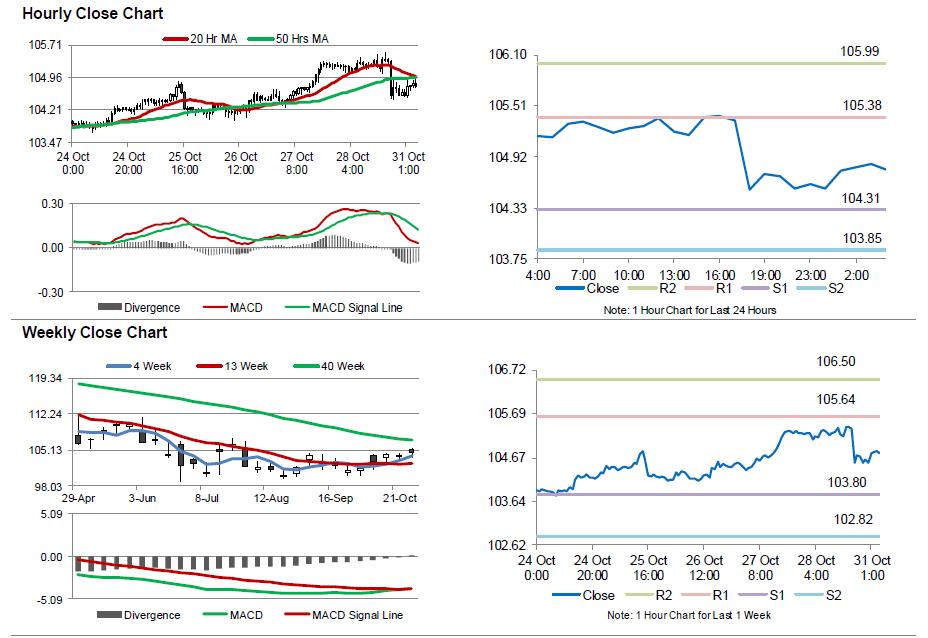

The pair is expected to find support at 104.31, and a fall through could take it to the next support level of 103.85. The pair is expected to find its first resistance at 105.38, and a rise through could take it to the next resistance level of 105.99.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.