For the 24 hours to 23:00 GMT, the USD declined 0.15% against the JPY and closed at 103.82 on Friday.

In the Asian session, at GMT0300, the pair is trading at 103.91, with the USD trading 0.09% higher against the JPY from Friday’s close.

Overnight data showed that Japan’s flash Nikkei manufacturing PMI advanced to a level of 51.7 in October, expanding at the fastest pace in nine-months, suggesting that manufacturing conditions in the nation continued to improve. The index recorded a reading of 50.4 in the preceding month. Additionally, the nation’s total merchandise trade surplus widened to a level of ¥498.3 billion in September, more than market expectations of a surplus of ¥366.1 billion and after posting a revised deficit of ¥19.2 billion in the previous month. Meanwhile, the nation’s exports and imports declined less-than-expected by 6.9% and 16.3% respectively, on an annual basis, in September.

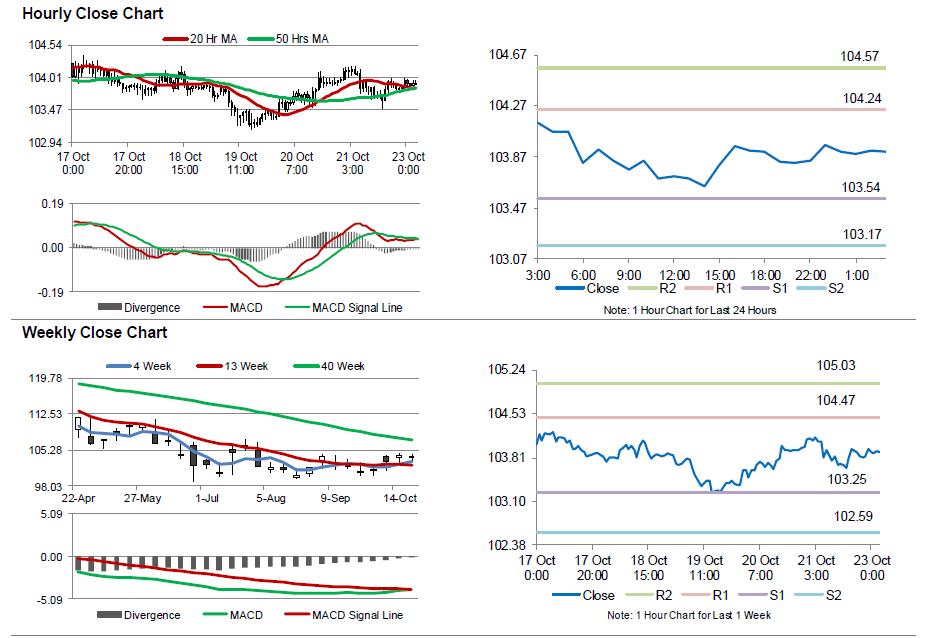

The pair is expected to find support at 103.54, and a fall through could take it to the next support level of 103.17. The pair is expected to find its first resistance at 104.24, and a rise through could take it to the next resistance level of 104.57.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.