For the 24 hours to 23:00 GMT, the USD declined 0.42% against the JPY and closed at 102.91.

In the Asian session, at GMT0400, the pair is trading at 103.04, with the USD trading 0.13% higher against the JPY from yesterday’s close.

Overnight data showed that, Japan’s Markit services PMI rose to a level of 50.5 in October, crawling out of the contraction territory for the first time in three months, thus suggesting that suggesting a pick up in the nation’s consumer spending, compared to a level of 48.2 in the previous month.

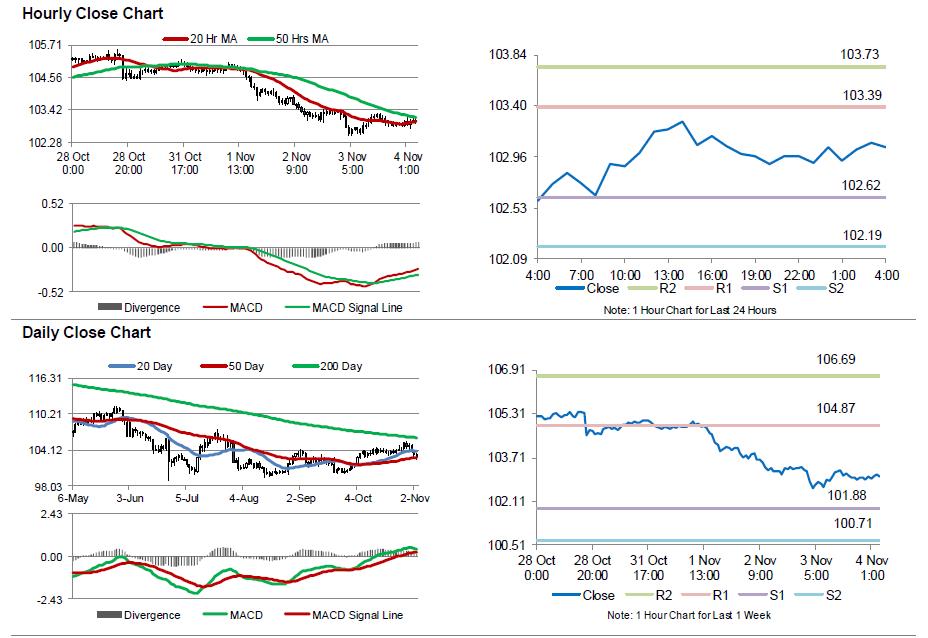

The pair is expected to find support at 102.62, and a fall through could take it to the next support level of 102.19. The pair is expected to find its first resistance at 103.39, and a rise through could take it to the next resistance level of 103.73.

Moving ahead, BoJ’s September meeting minutes, trade balance (BOP basis), Eco Watchers’ survey, tertiary industry index and machine orders, all slated to release next week, would keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.