For the 24 hours to 23:00 GMT, the USD rose 0.17% against the JPY and closed at 112.58 on Friday.

In the Asian session, at GMT0300, the pair is trading at 112.83, with the USD trading 0.22% higher against the JPY from Friday’s close.

Overnight data indicated that Japan’s final Nikkei manufacturing PMI rose more than initially estimated to a level of 52.9 in September, following a level of 52.2 in the prior month. The preliminary figures had recorded an advance to a level of 52.6.

Additionally, the nation’s Tankan large manufacturing index registered a rise to a level of 22.0 in 3Q 2017, topping market expectations of a rise to a level of 18.0 and notching its highest level since September 2007. In the prior quarter, the index had recorded a reading of 17.0. Further, the nation’s Tankan non-manufacturing index remained unchanged at a level of 23.0 in 3Q 2017, while markets were expecting the index to climb to a level of 24.0.

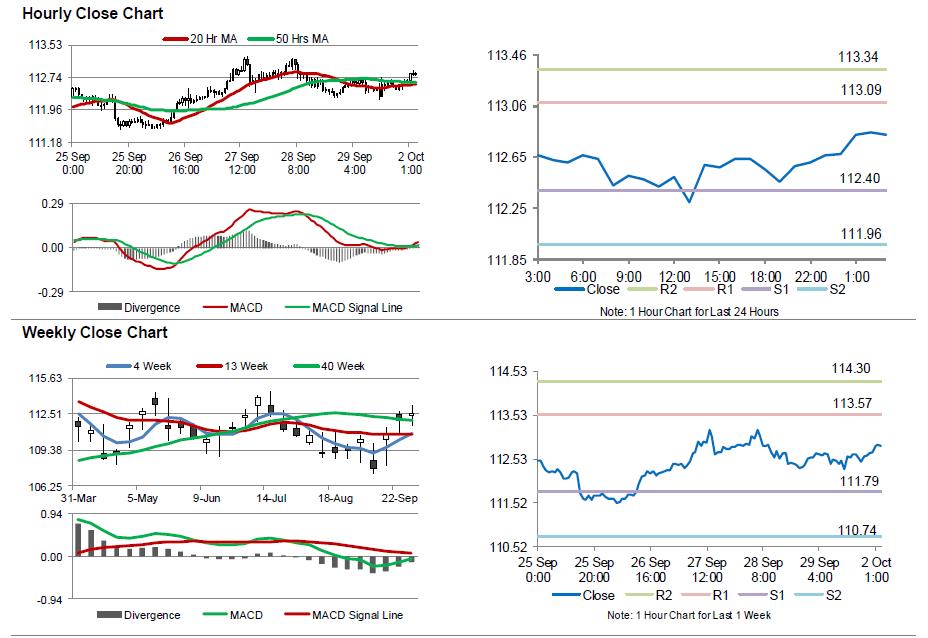

The pair is expected to find support at 112.4, and a fall through could take it to the next support level of 111.96. The pair is expected to find its first resistance at 113.09, and a rise through could take it to the next resistance level of 113.34.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.