For the 24 hours to 23:00 GMT, the USD declined 0.31% against the JPY and closed at 99.96.

In the Asian session, at GMT0300, the pair is trading at 100.02, with the USD trading 0.06% higher against the JPY from yesterday’s close.

Overnight data indicated that, Japan’s total merchandise trade surplus narrowed to ¥513.5 billion in July, amid weaker demand and a stronger Yen. The nation posted a revised trade surplus of ¥693.1 billion in the previous month while markets expected a trade surplus of ¥273.2 billion. Meanwhile, the nation’s exports fell at the fastest pace in seven years, after it dropped 14.0% YoY in July, more than market expectations for a drop of 13.7% and after registering a fall of 7.4% in the previous month. Further, imports eased more-than-anticipated by 24.7% on an annual basis in July, compared to market expectations for a fall of 20.0% and following a drop of 18.8% In the prior month.

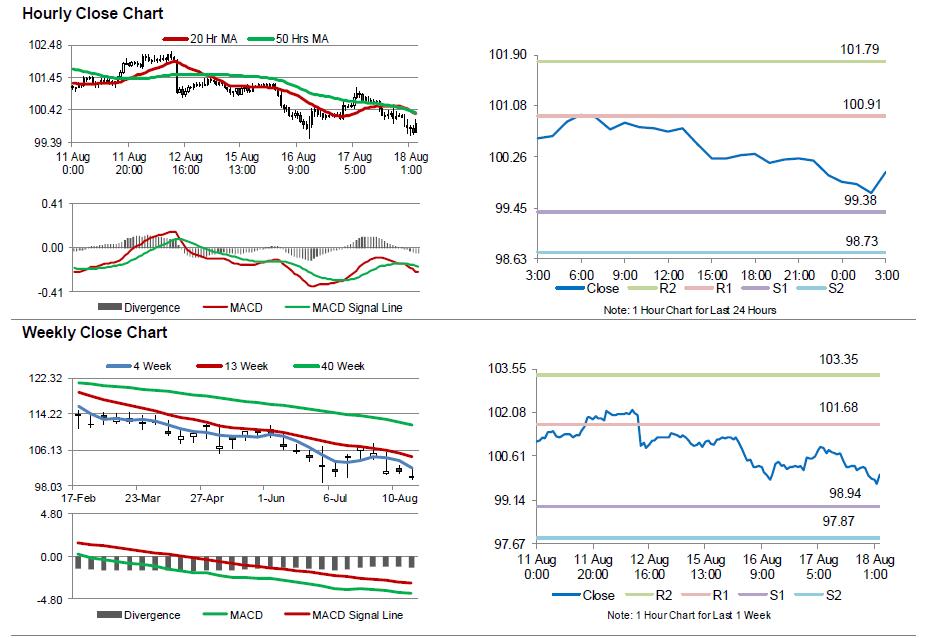

The pair is expected to find support at 99.38, and a fall through could take it to the next support level of 98.73. The pair is expected to find its first resistance at 100.91, and a rise through could take it to the next resistance level of 101.79.

Moving ahead, Japan’s all industry activity index for June, slated to release tomorrow morning, would be on investor’s radar.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.