For the 24 hours to 23:00 GMT, the USD weakened 0.35% against the JPY and closed at 120.15.

Yesterday, the BoJ Governor, Haruhiko Kuroda reiterated that the central bank stands ready to inject further monetary stimulus in the Japanese economy, but refrained from giving any signal on whether it will ease monetary policy further in the near term.

In the Asian session, at GMT0300, the pair is trading at 119.91, with the USD trading 0.2% lower from yesterday’s close.

Minutes of Bank of Japan’s (BOJ) recent monetary policy meeting indicated that the country’s economic recovery continued with the increase in private consumption and housing investment. Further, the BOJ noted that inflation expectations appear to be rising and the central bank will continue with its quantitative and qualitative easing (QQE) program in an attempt to achieve inflationary targets of 2%.

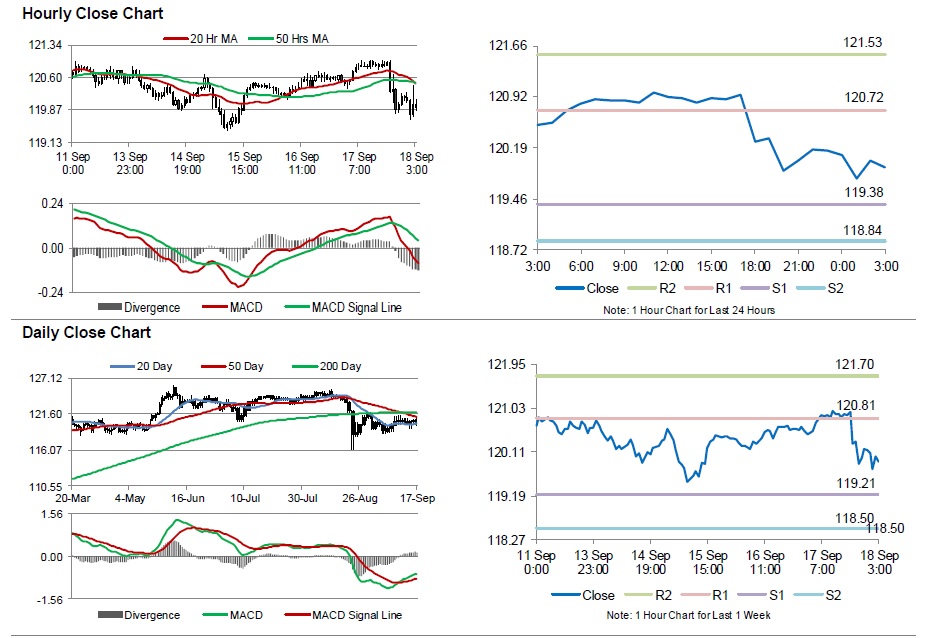

The pair is expected to find support at 119.38, and a fall through could take it to the next support level of 118.84. The pair is expected to find its first resistance at 120.72, and a rise through could take it to the next resistance level of 121.53.

Meanwhile, market participants would closely monitor Japan’s crucial CPI data, scheduled next week.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.