For the 24 hours to 23:00 GMT, the USD strengthened 0.63% against the JPY and closed at 108.79, after the Fed agreed to end its third and final round of quantitative easing program, at its recently concluded monetary policy meeting.

In the Asian session, at GMT0400, the pair is trading at 109.05, with the USD trading 0.24% higher from yesterday’s close.

Earlier today, the Japanese Prime Minister Shinzo Abe indicated that he would closely watch whether any future hike in the nation’s sales tax would hamper the nation’s prospects for ending deflation as a higher tax would affect consumers’ purchasing power.

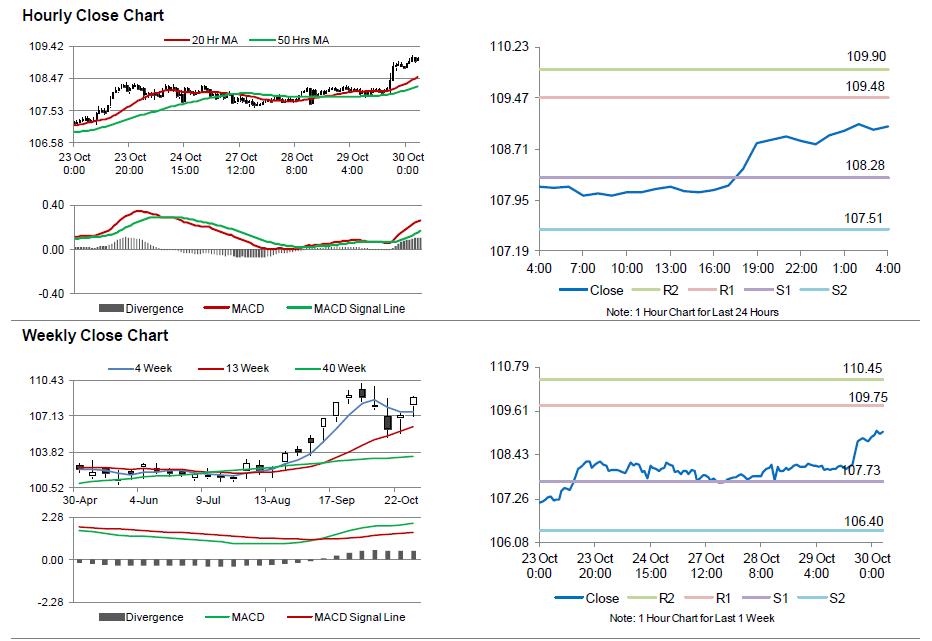

The pair is expected to find support at 108.28, and a fall through could take it to the next support level of 107.51. The pair is expected to find its first resistance at 109.48, and a rise through could take it to the next resistance level of 109.9.

Going forward, market participants await Japan’s national CPI as well as jobless rate data, scheduled overnight. Additionally, the BoJ’s monetary policy statement, scheduled tomorrow would give better insights about the nation’s economy.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.