For the 24 hours to 23:00 GMT, the USD declined 1.01% against the JPY and closed at 119.79.

In the Asian session, at GMT0400, the pair is trading at 119.66, with the USD trading 0.11% lower from yesterday’s close.

Early this morning, the BoJ Governor, Haruhiko Kuroda, stated that the central bank is flexible to expand stimulus further and if necessary the central bank will adopt negative interest rates further to achieve the inflation target.

Separately, the BoJ minutes of its December monetary policy meeting indicated that board members were unanimous in their decision to maintain the monetary policy as they noted that underlying inflation trend was improving steadily.

In other economic news, Japan’s Nikkei services PMI advanced to a level of 52.4 in January from a reading of 51.5 in the previous month.

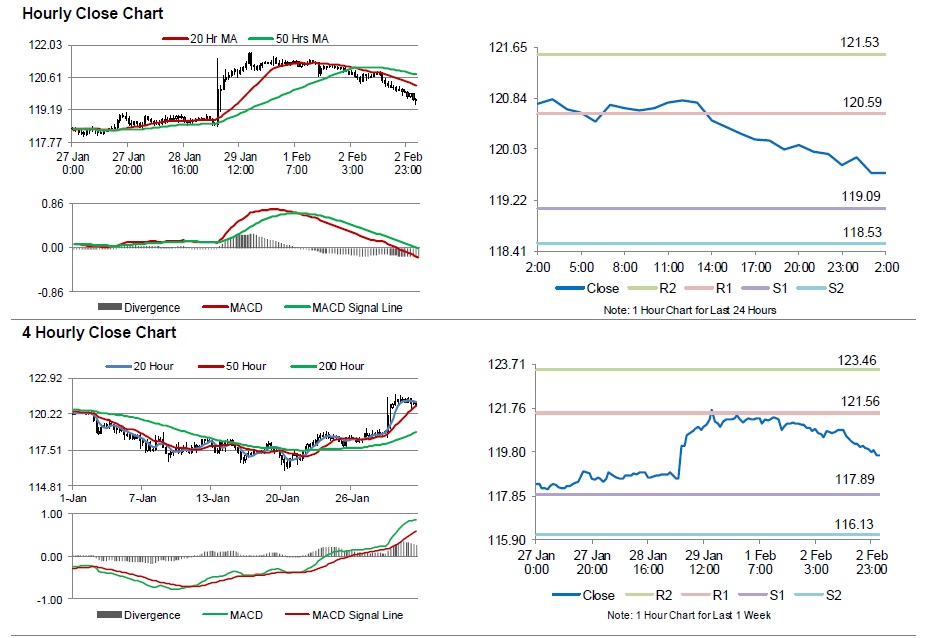

The pair is expected to find support at 119.08, and a fall through could take it to the next support level of 118.50. The pair is expected to find its first resistance at 120.57, and a rise through could take it to the next resistance level of 121.49.

Looking ahead, investors will look forward to Japan’s consumer confidence index data, scheduled to be released in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.