For the 24 hours to 23:00 GMT, the USD declined 0.76% against the JPY and closed at 108.88.

The Japanese Yen gained ground against the USD, as investors fretted over the US President Donald Trump’s warning of the Federal Government shut-down if Congress fails to fund his long-promised border wall with Mexico.

In economic news, Japan’s final machine tool orders advanced more than initially estimated by 28.0% on an annual basis in July, after recording a gain of 31.1% in the previous month. The preliminary figures had indicated an advance of 26.3%.

In the Asian session, at GMT0300, the pair is trading at 109.17, with the USD trading 0.27% higher against the JPY from yesterday’s close.

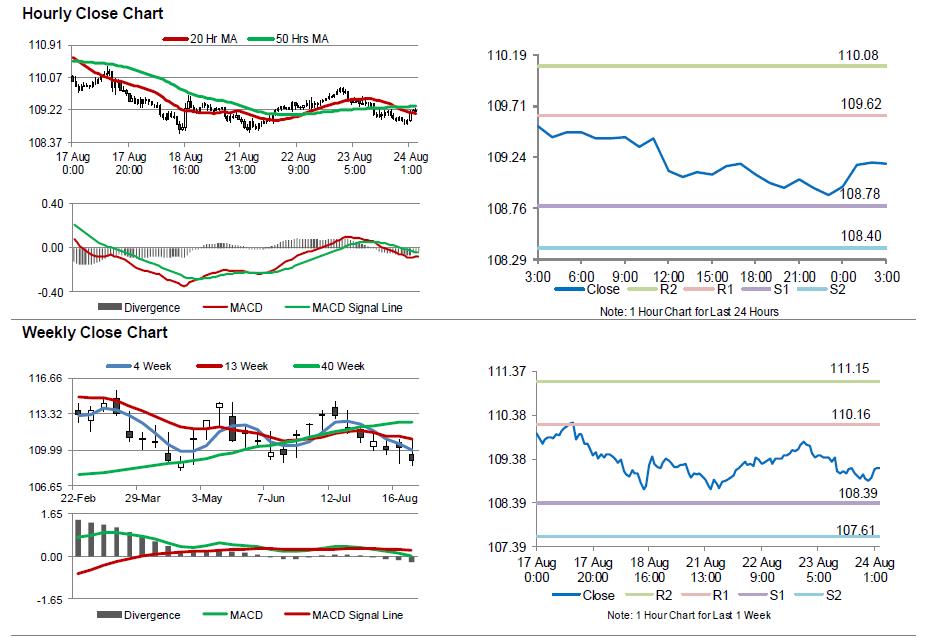

The pair is expected to find support at 108.78, and a fall through could take it to the next support level of 108.4. The pair is expected to find its first resistance at 109.62, and a rise through could take it to the next resistance level of 110.08.

Looking forward, Japan’s national consumer price index for July, scheduled to release overnight, will be on investors’ radar.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.