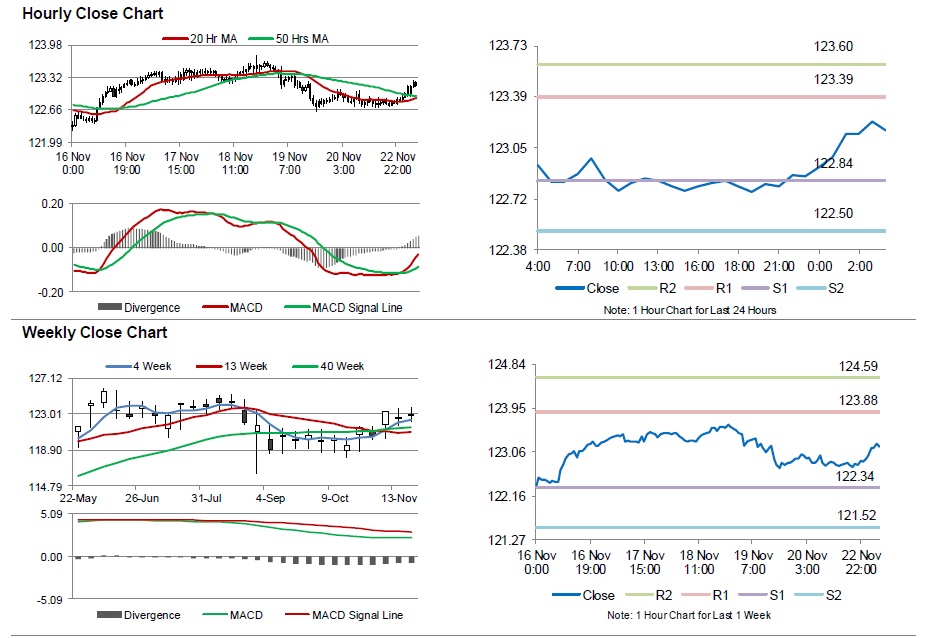

For the 24 hours to 23:00 GMT, the USD weakened marginally against the JPY and closed at 122.84.

On Friday, BoJ board member, Sayuri Shirai, indicated that Japan’s inflation rate is expected to rise in the near future, adding that a higher wage growth was essential to attain the central bank’s 2.0% inflation target. She further stated that the BoJ should continue to maintain an accommodative monetary environment in order to support positive developments in the economy.

In the Asian session, at GMT0400, the pair is trading at 123.17, with the USD trading 0.27% higher from Friday’s close.

The pair is expected to find support at 122.84, and a fall through could take it to the next support level of 122.50. The pair is expected to find its first resistance at 123.39, and a rise through could take it to the next resistance level of 123.60.

Moving ahead, investors will look forward to Japan’s Nikkei flash manufacturing PMI for November, scheduled to be released early morning tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.