For the 24 hours to 23:00 GMT, the USD weakened 3.06% against the JPY and closed at 108.10.

In economic news, Japan’s housing starts unexpectedly accelerated by 8.4% YoY in March, its steepest rise since August 2015, against market expectations for a drop of 0.6%. In the previous month, housing starts had advanced 7.8%. Moreover, the nation’s construction orders rebounded 19.8% YoY in March, its first expansion in three months, following a 12.4% fall in the previous month.

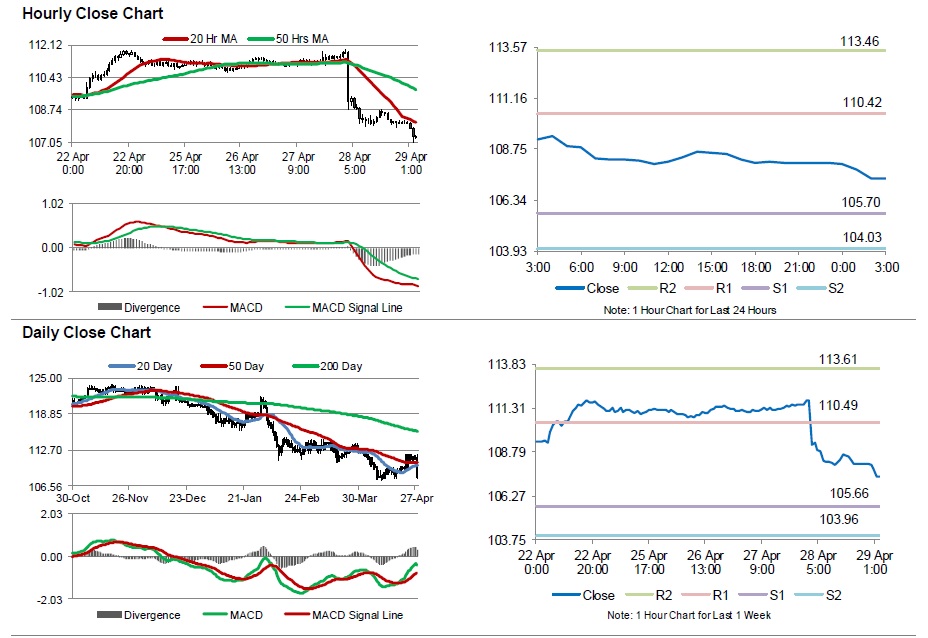

In the Asian session, at GMT0300, the pair is trading at 107.37, with the USD trading 0.68% lower from yesterday’s close.

The pair is expected to find support at 105.70, and a fall through could take it to the next support level of 104.03. The pair is expected to find its first resistance at 110.42, and a rise through could take it to the next resistance level of 113.46.

On account of a holiday observed in Japan today, investors will look forward to the nation’s Nikkei manufacturing and services indices data, scheduled to release next week.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.