For the 24 hours to 23:00 GMT, the USD rose 0.08% against the JPY and closed at 119.74, after upbeat US inflation and housing data underpinned the case for an increase in interest rate by the Federal Reserve in the coming months.

In the Asian session, at GMT0300, the pair is trading at 119.60, with the USD trading 0.11% lower from yesterday’s close.

Earlier today, the Bank of Japan indicated that the nation’s corporate service price index recorded a rise of 3.30% on a YoY basis in February, meeting market expectations. In the previous month, the corporate service price index had advanced by a revised 3.50%.

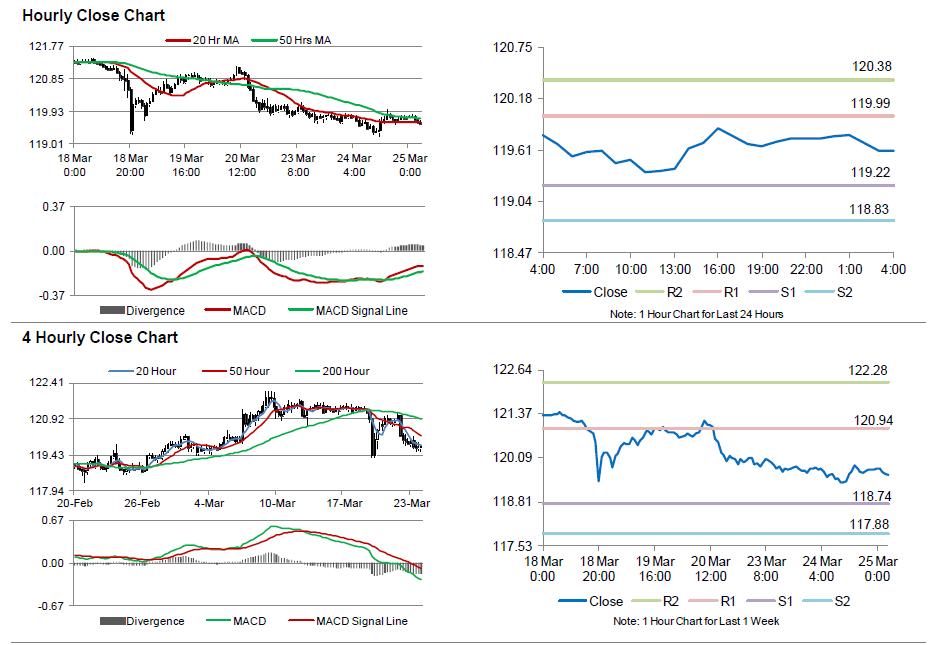

The pair is expected to find support at 119.22, and a fall through could take it to the next support level of 118.83. The pair is expected to find its first resistance at 119.99, and a rise through could take it to the next resistance level of 120.38.

Investors would pay attention to the release of national CPI data along with jobless rate from Japan scheduled late tomorrow.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.