For the 24 hours to 23:00 GMT, the USD rose 0.89% against the JPY and closed at 109.70.

In the Asian session, at GMT0400, the pair is trading at 109.33, with the USD trading 0.34% lower against the JPY from yesterday’s close.

Earlier today, data indicate that Japan’s flash leading economic index eased more-than-anticipated to a level of 107.9 in December, compared to a reading of 108.3 in the prior month, while investors had envisaged for a fall to a level of 108.1. On the contrary, the nation’s preliminary coincident index advanced to a level of 120.7 in December, surpassing market expectations for a rise to a level of 120.5. The index had recorded a level of 117.9 in the previous month.

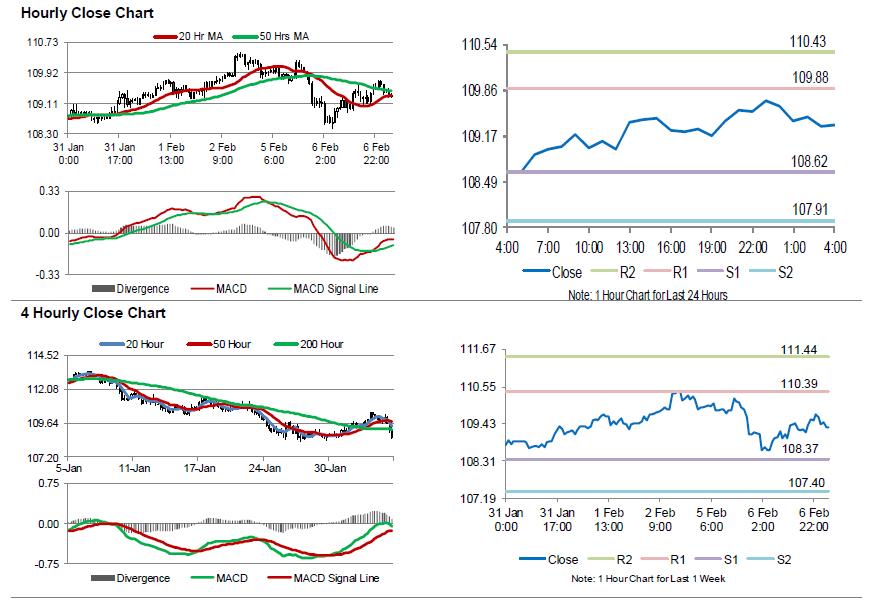

The pair is expected to find support at 108.62, and a fall through could take it to the next support level of 107.91. The pair is expected to find its first resistance at 109.88, and a rise through could take it to the next resistance level of 110.43.

Going ahead, investors would closely monitor Japan’s trade balance (BOP basis) for December and the Eco-Watchers survey for January, both due to release overnight.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.