For the 24 hours to 23:00 GMT, the USD strengthened 0.73% against the JPY and closed at 118.44.

In the Asian session, at GMT0400, the pair is trading at 118.21, with the USD trading 0.2% lower from yesterday’s close.

Earlier today, Japan’s Economic Minister, Akira Amari stated that the BoJ would need more time that to achieve its 2% inflation target, as a continuous fall in oil prices was delaying the central bank’s efforts to reach its inflation goal.

Overnight data showed that Japan’s corporate service price index unexpectedly recorded a rise of 3.6% on a YoY basis, in December. The index had registered a similar rise in the prior month.

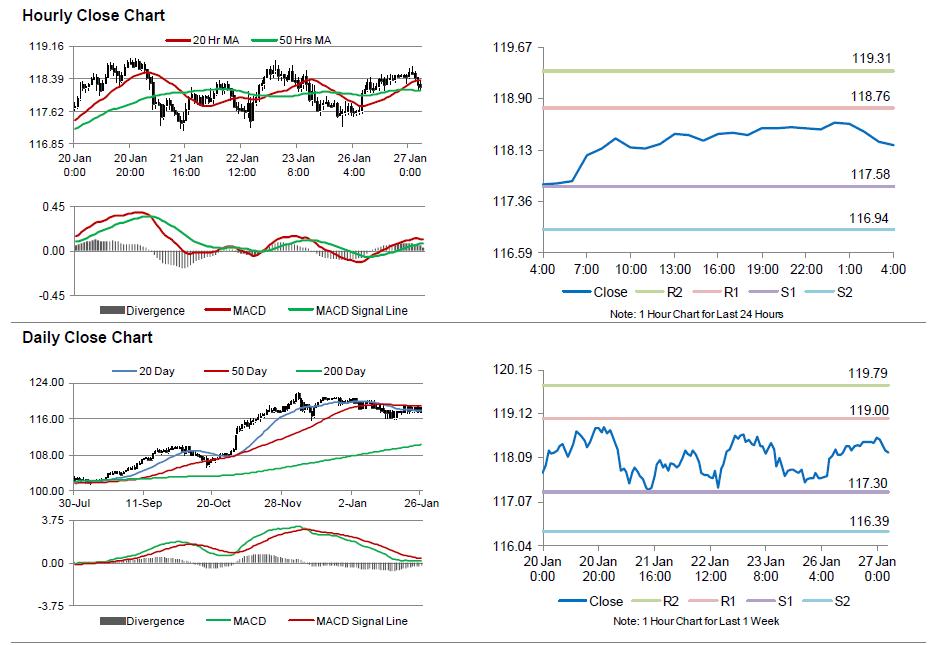

The pair is expected to find support at 117.58, and a fall through could take it to the next support level of 116.94. The pair is expected to find its first resistance at 118.76, and a rise through could take it to the next resistance level of 119.31.

Amid a light economic calendar in Japan this week, investors await Japan’s crucial CPI data, scheduled on Friday.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.