For the 24 hours to 23:00 GMT, USD weakened 0.17% against the JPY and closed at 83.63, as Japan’s nuclear crisis deepens. US officials warned of a possible catastrophic nuclear situation in Japan spreading fears and global uncertainty.

In the US, on a monthly basis, the producer price index rose 0.7% in March, compared to a 1.6% gain recorded in the previous month.

In Japan, today morning, The Real Estate Economic Institute Co. reported that a total of 3,685 new condominiums were put for sale in the greater Tokyo area in March, unchanged from the previous year.

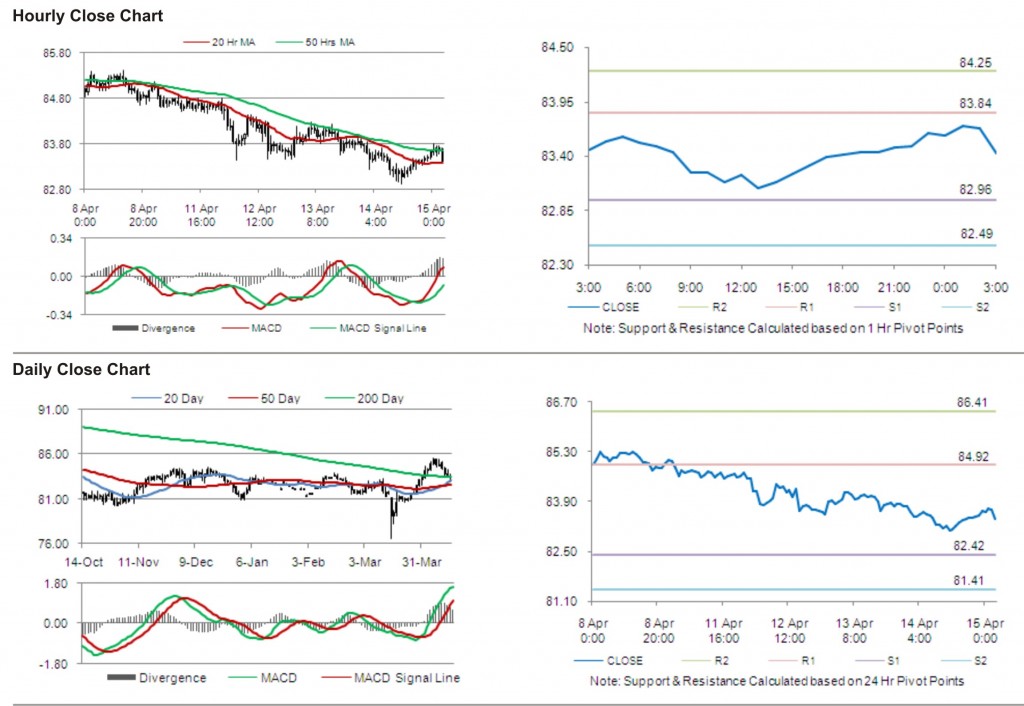

In the Asian session at 3:00GMT, the pair is trading lower from the New York close, by 0.25%, at 83.42.

The first short term resistance is at 83.84, followed by 84.25. The pair is expected to find support at 82.96 and the subsequent support level at 82.49.

Trading trends in the pair today are expected to be determined by release of data on industrial production and capacity utilization in Japan.

The currency pair is showing convergence with its 20 Hr moving average and its 50 Hr moving average.