For the 24 hours to 23:00 GMT, the USD rose 0.25% against the JPY and closed at 104.50.

In the Asian session, at GMT0400, the pair is trading at 104.46, with the USD trading slightly lower against the JPY from yesterday’s close.

On the data front, Japan’s flash leading economic index fell to a level of 100.5 in September, against market expectations of 100.2. The leading economic index had registered a level of 100.9 in the prior month. Moreover, the nation’s preliminary coincident index edged up to a level of 112.1 in September, meeting market expectations, compared to a level of 112.0 in the prior month.

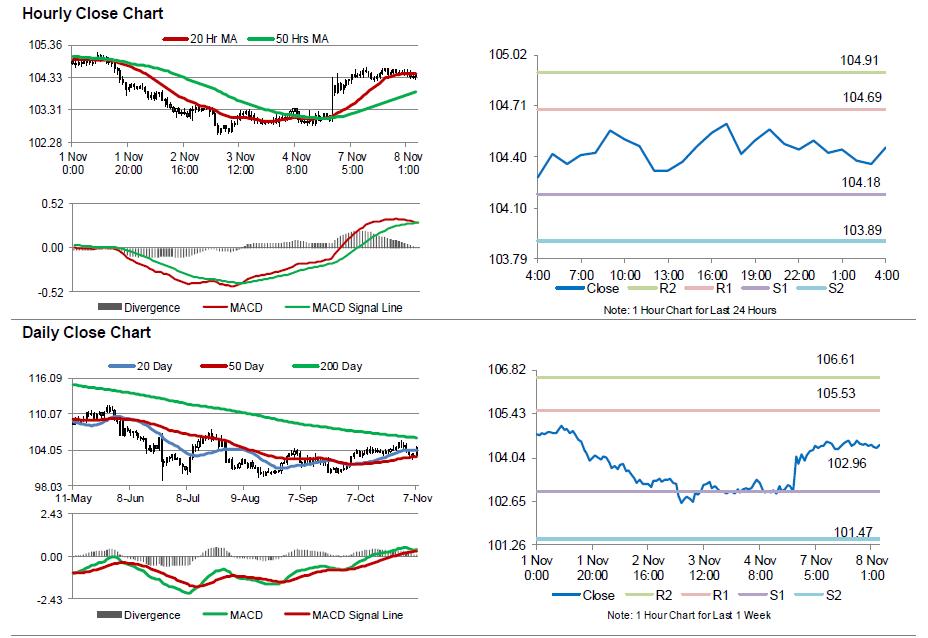

The pair is expected to find support at 104.18, and a fall through could take it to the next support level of 103.89. The pair is expected to find its first resistance at 104.69, and a rise through could take it to the next resistance level of 104.91.

Investors would turn their attention to Japan’s trade balance (BOP basis) for September, due to release overnight along with the nation’s Eco Watcher’s survey and machine tool orders, both for October, slated to release in the early hours of tomorrow.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.