For the 24 hours to 23:00 GMT, the USD declined 0.57% against the JPY and closed at 111.81.

In the Asian session, at GMT0400, the pair is trading at 111.87, with the USD trading slightly higher against the JPY from yesterday’s close.

Earlier today, data revealed that Japan’s flash leading economic index climbed less-than-expected to a level of 105.2 in December, compared to a level of 102.8 in the previous month, while investors had envisaged the index to rise to a level of 105.5. On the contrary, the preliminary coincident index nudged higher to a level of 115.2 in December, surpassing market expectations of an increase to a level of 115.1. In the previous month, the index had recorded a reading of 115.0.

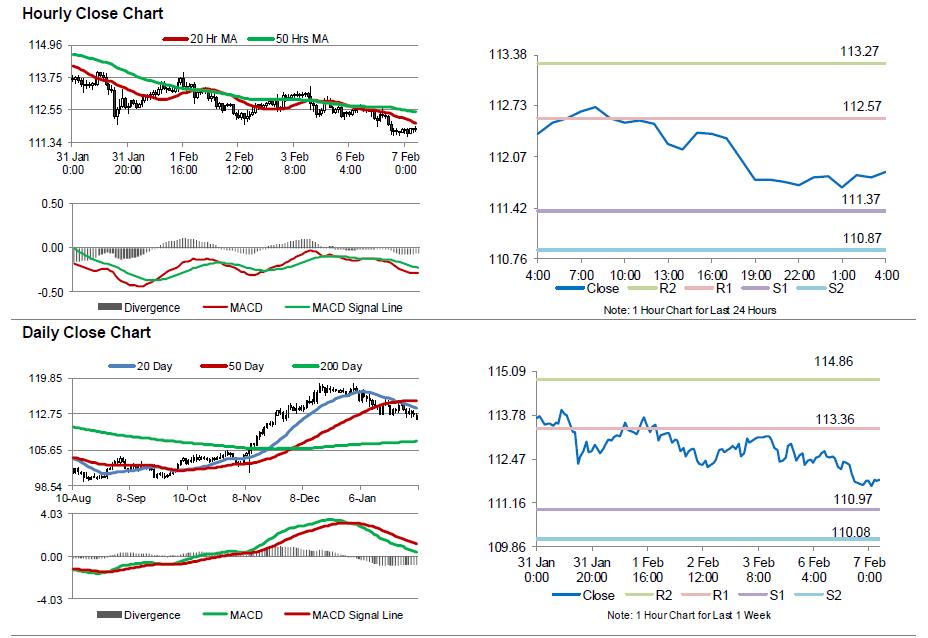

The pair is expected to find support at 111.37, and a fall through could take it to the next support level of 110.87. The pair is expected to find its first resistance at 112.57, and a rise through could take it to the next resistance level of 113.27.

Moving ahead, Japan’s trade balance (BOP basis) data for December and the BoJ’s summary of opinions report from its January meeting, both slated to release overnight, would garner significant amount of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.