For the 24 hours to 23:00 GMT, the USD declined 0.42% against the JPY and closed at 109.92.

On the data front, Japan’s final machine tool orders advanced 14.9% on an annual basis in May, confirming the preliminary print. In the previous month, machine tool orders had registered a rise of 22.0%.

In the Asian session, at GMT0300, the pair is trading at 110.04, with the USD trading 0.11% higher against the JPY from yesterday’s close.

Overnight data revealed that Japan’s national consumer price index (CPI) rose more-than-anticipated to 0.7% on an annual basis in May, compared to a gain of 0.6% in the prior month. Markets consensus was for the CPI to climb 0.6%.

Earlier in the session, the nation’s Nikkei flash manufacturing PMI advanced to a level of 53.1, compared to a reading of 52.8 in the previous month. Meanwhile, all industry activity index climbed 1.0% on a monthly basis in April, more than market expectations and compared to a flat reading in the previous month.

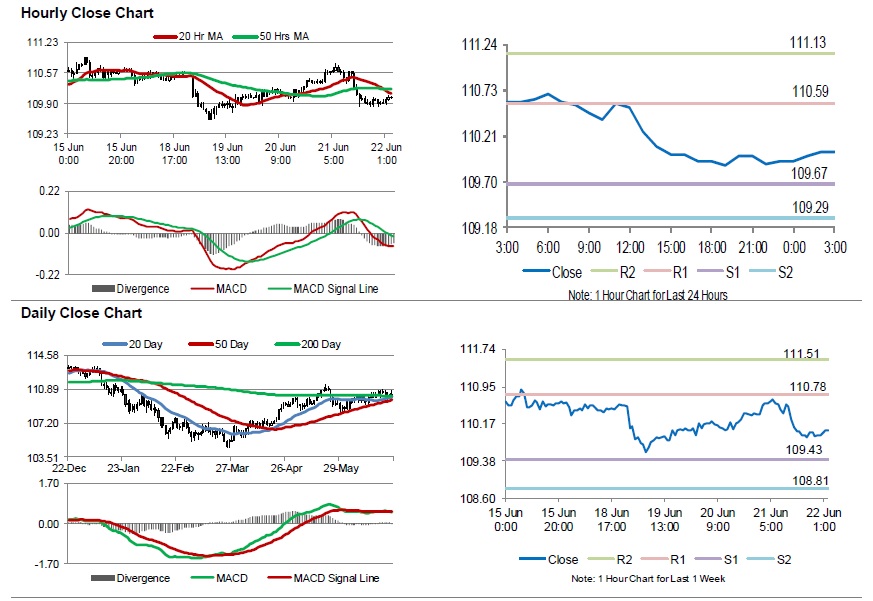

The pair is expected to find support at 109.67, and a fall through could take it to the next support level of 109.29. The pair is expected to find its first resistance at 110.59, and a rise through could take it to the next resistance level of 111.13.

Moving ahead, traders would closely monitor Japan’s jobless rate, industrial production and consumer confidence all set to release next week.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.