For the 24 hours to 23:00 GMT, the USD traded marginally lower against the JPY and closed at 121.35. The Japanese currency gained ground, after Japan’s final Leading and Coincident indices edged up in February.

Data indicated that the final leading economic index in Japan rose to 105.5 in January, compared to a preliminary reading of 105.1. In December, the index had registered a reading of 105.8. Additionally, the nation’s coincident index climbed to 113.3 in January, compared to preliminary reading of 113.0. The index had registered a reading of 110.9 in the preceding month.

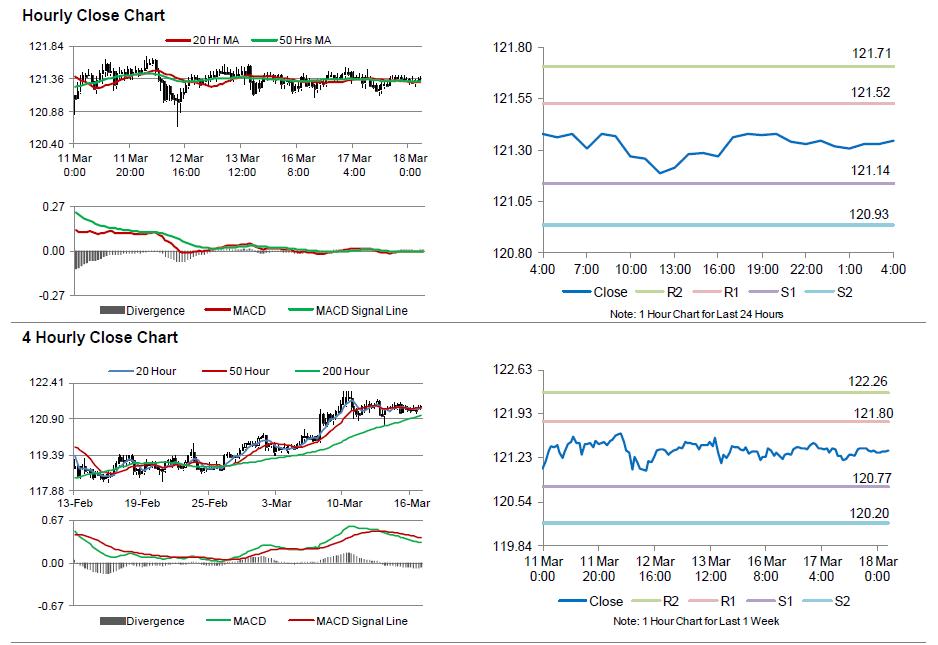

In the Asian session, at GMT0400, the pair is trading at 121.34, with the USD trading flat from yesterday’s close.

Earlier today, data showed that Japan’s merchandise (total) trade deficit dropped to ¥424.60 billion in February from a revise trade deficit of ¥1179.10 billion in the previous month. Markets were anticipating the nation to record a deficit of ¥1000.80 billion

The pair is expected to find support at 121.14, and a fall through could take it to the next support level of 120.93. The pair is expected to find its first resistance at 121.52, and a rise through could take it to the next resistance level of 121.71.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.