For the 24 hours to 23:00 GMT, the USD strengthened 0.17% against the JPY and closed at 120.02.

In the Asian session, at GMT0300, the pair is trading at 119.83, with the USD trading 0.16% lower from yesterday’s close.

Overnight release of minutes of the BoJ’s recent monetary policy meeting held during September 14-15, indicated that monetary policy board members were of the opinion that Japan’s economy continued to recover moderately, even though exports and production have been affected by the slowdown in emerging economies. It further stated revealed that policymakers expressed concern about consumer prices falling in the year ended March, due to a decline in energy prices. Additionally, the central bank reported that it will continue with its quantitative and qualitative monetary easing to achieve the price stability target of 2.0%.

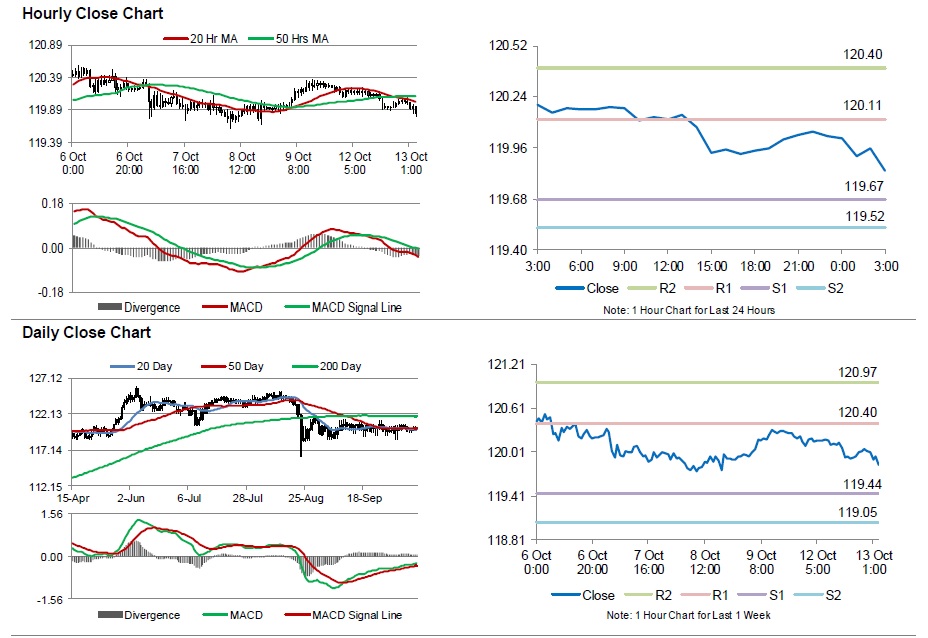

The pair is expected to find support at 119.67, and a fall through could take it to the next support level of 119.52. The pair is expected to find its first resistance at 120.11, and a rise through could take it to the next resistance level of 120.40.

Moving ahead, Japan’s consumer confidence index data and machine tool orders data, both for the month of September, scheduled to be released in a few hours, will attract a significant amount of investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.