For the 24 hours to 23:00 GMT, the USD weakened 0.20% against the JPY and closed at 119.98The Japanese currency gained ground, after the BoJ refrained from expanding its QE programme. Additionally, the BoJ Governor, Haruhiko Kuroda, in his press conference highlighted positive signs in the Japanese economy, in contrast to views of some private economists. The Governor further stated that the central bank would not hesitate to adjust its policy if needed to attain its 2.0% inflation target.

In other economic news, Japan’s preliminary leading index fell less-than-expected to a level of 103.5 in August, from a reading of 105.0 in the previous month. However, this was its lowest level in fifteen months. Moreover, the nation’s flash coincident index for the same month, slipped 0.6 points to a level of 112.5, from 113.1 in July.

In the Asian session, at GMT0300, the pair is trading at 119.94, with the USD trading marginally lower from yesterday’s close.

Overnight data revealed that, Japan recorded a trade deficit of ¥326.1 billion in August, from ¥108.0 billion in the previous month. Also, the country’s machine orders unexpectedly fell 5.7% MoM in August, from a 3.6% decline in July, while investors had expected it to increase 3.2%.

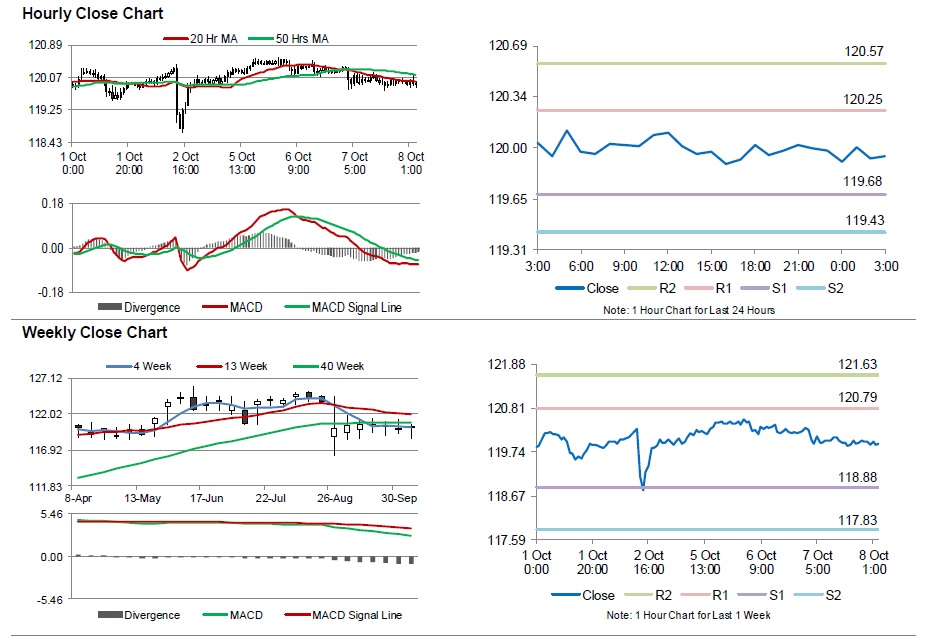

The pair is expected to find support at 119.68, and a fall through could take it to the next support level of 119.43. The pair is expected to find its first resistance at 120.25, and a rise through could take it to the next resistance level of 120.57.

Going ahead, investors will closely monitor the Eco watchers current and outlook indices data, for September, scheduled to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.