For the 24 hours to 23:00 GMT, the USD weakened 0.94% against the JPY and closed at 119.16, on the back of downbeat economic releases in the US.

Yesterday, the BoJ said it would not add extra stimulus measures in an effort to protect the currency from further weakening.

In other economic news, machine tool orders in Japan rose 20.4% on an annual basis in January, following a rise of 33.9% registered in the preceding month.

In the Asian session, at GMT0400, the pair is trading at 118.54, with the USD trading 0.52% lower from yesterday’s close.

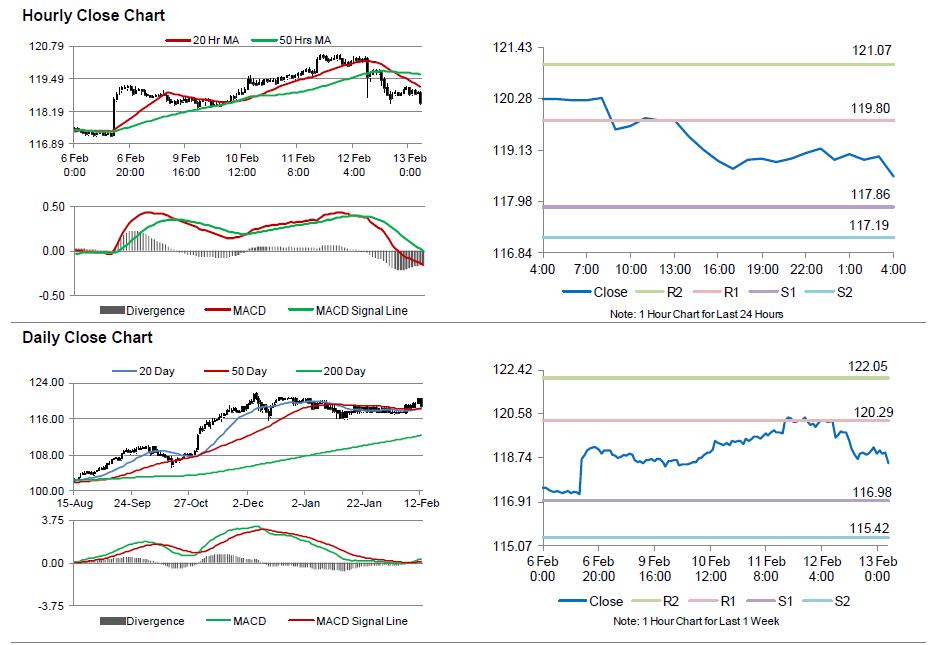

The pair is expected to find support at 117.86, and a fall through could take it to the next support level of 117.19. The pair is expected to find its first resistance at 119.8, and a rise through could take it to the next resistance level of 121.07.

Looking ahead, investors await the release of Japan’s Q4 GDP data, scheduled on Monday, which is expected to see a rebound after recession hit the nation in the previous two quarters.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.