For the 24 hours to 23:00 GMT, the USD rose 1.96% against the JPY and closed at 110.01.

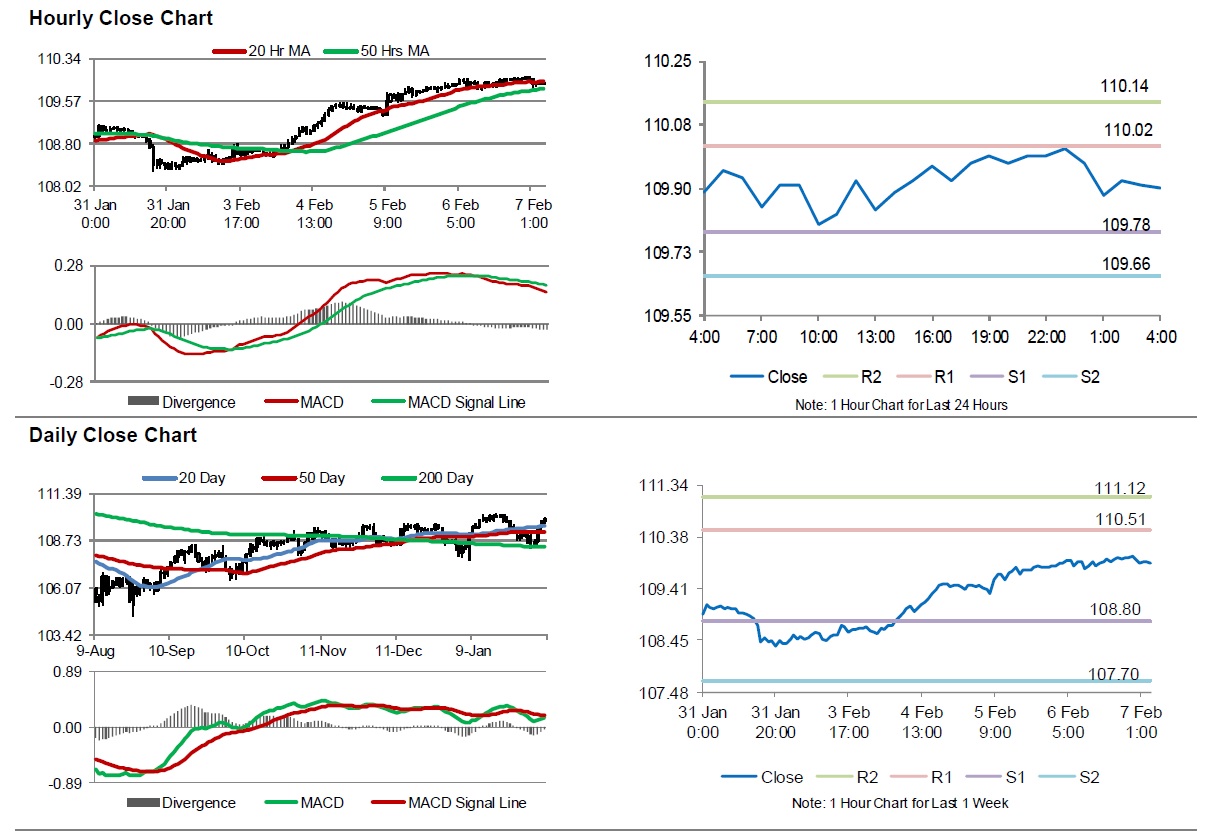

In the Asian session, at GMT0400, the pair is trading at 109.90, with the USD trading 0.10% lower against the JPY from yesterday’s close.

Overnight data indicated that Japan’s household spending dropped 4.8% on an annual basis in December, compared to a decline of 2.0% in the previous month. Meanwhile, the leading economic index unexpectedly rose to a level of 91.6 in December, compared to market expectations for a steady reading. The leading economic index had registered a reading of 90.8 in the prior month.

The pair is expected to find support at 109.78, and a fall through could take it to the next support level of 109.66. The pair is expected to find its first resistance at 110.02, and a rise through could take it to the next resistance level of 110.14.

Going ahead, market participants would focus on Japan’s producer price index, tertiary industry index, (BOP basis) trade balance and machine tool orders, all set to release next week.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.