For the 24 hours to 23:00 GMT, USD weakened slightly against the JPY, on Friday, and closed at 76.92.

This morning, according to minutes released from the Bank of Japan monetary policy board’s October 27 meeting, the members of the board believed that it was appropriate to increase its asset purchase program, designated for the purchase of Japanese government bonds,

At the meeting, the board enhanced monetary easing by lifting the asset purchase program to ¥55 trillion from ¥50 trillion. The central bank retained its benchmark uncollateralized overnight call rate at around 0-0.1% by a unanimous vote.

Additionally, in the morning economic news, the merchandise trade balance in Japan showed a deficit of ¥273.79 billion in October compared to a downwardly revised surplus of ¥296.2 billion in September. The All Industry Activity Index in Japan declined 0.4% (MoM) in September compared to a 0.3% decline in the previous month.

In the Asian session, at GMT0400, the pair is trading at 76.77, with the USD trading 0.20% lower from Friday’s close.

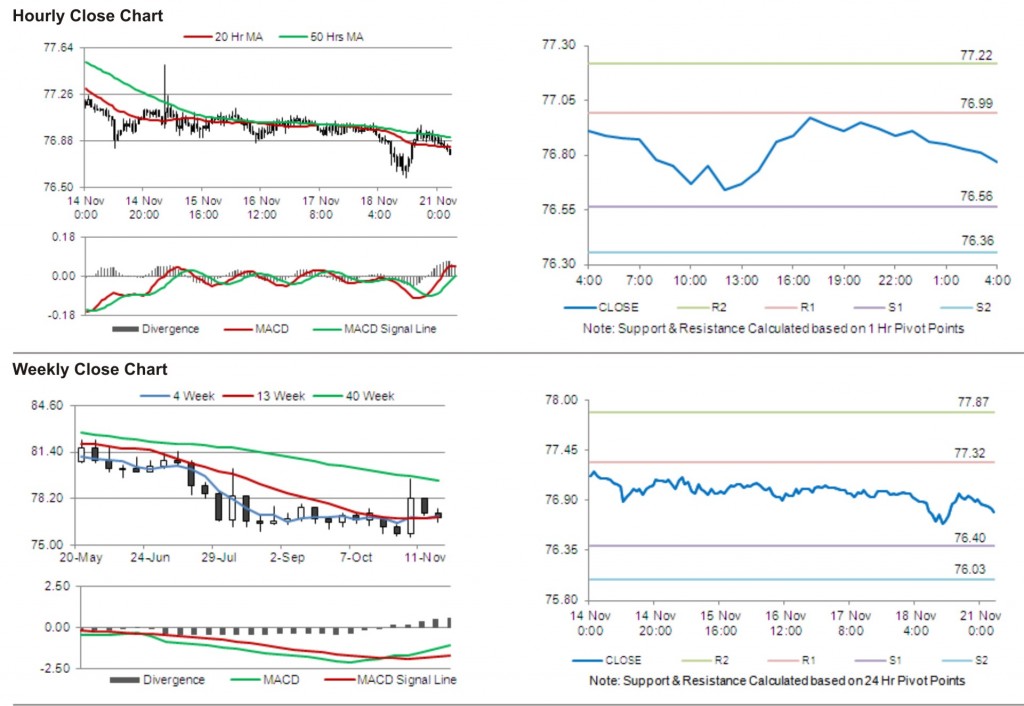

The pair is expected to find support at 76.56, and a fall through could take it to the next support level of 76.36. The pair is expected to find its first resistance at 76.99, and a rise through could take it to the next resistance level of 77.22.

Trading trends in the pair today are expected to be determined by release of Leading Economic Index and Coincident Index in Japan.

The currency pair is trading just below its 20 Hr and 50 Hr moving averages.