On Friday, the USD strengthened 0.17% against the JPY and closed at 108.93. The Japanese currency came under pressure after Japan’s leading index registered a level of 105.4 in July, down from previous month’s 106.5. Meanwhile, the nation’s coincident index came in at 109.9 in July, from prior month’s revised reading of 109.3. Also, the nationwide department store sales in Japan dropped 0.3%, on an annual basis, in July, after registering a drop of 2.5% in June.

Separately, the Japanese Government, in its monthly economic report, downgraded the nation’s economic assessment for the first time in five months in September, citing that private consumption is still struggling to recover from the slump caused by April’s sales tax hike. It further indicated that the employment situation in the country is improving steadily and the consumer prices are rising moderately.

In the Asian session, at GMT0300, the pair is trading at 108.69, with the USD trading 0.22% lower from Friday’s close.

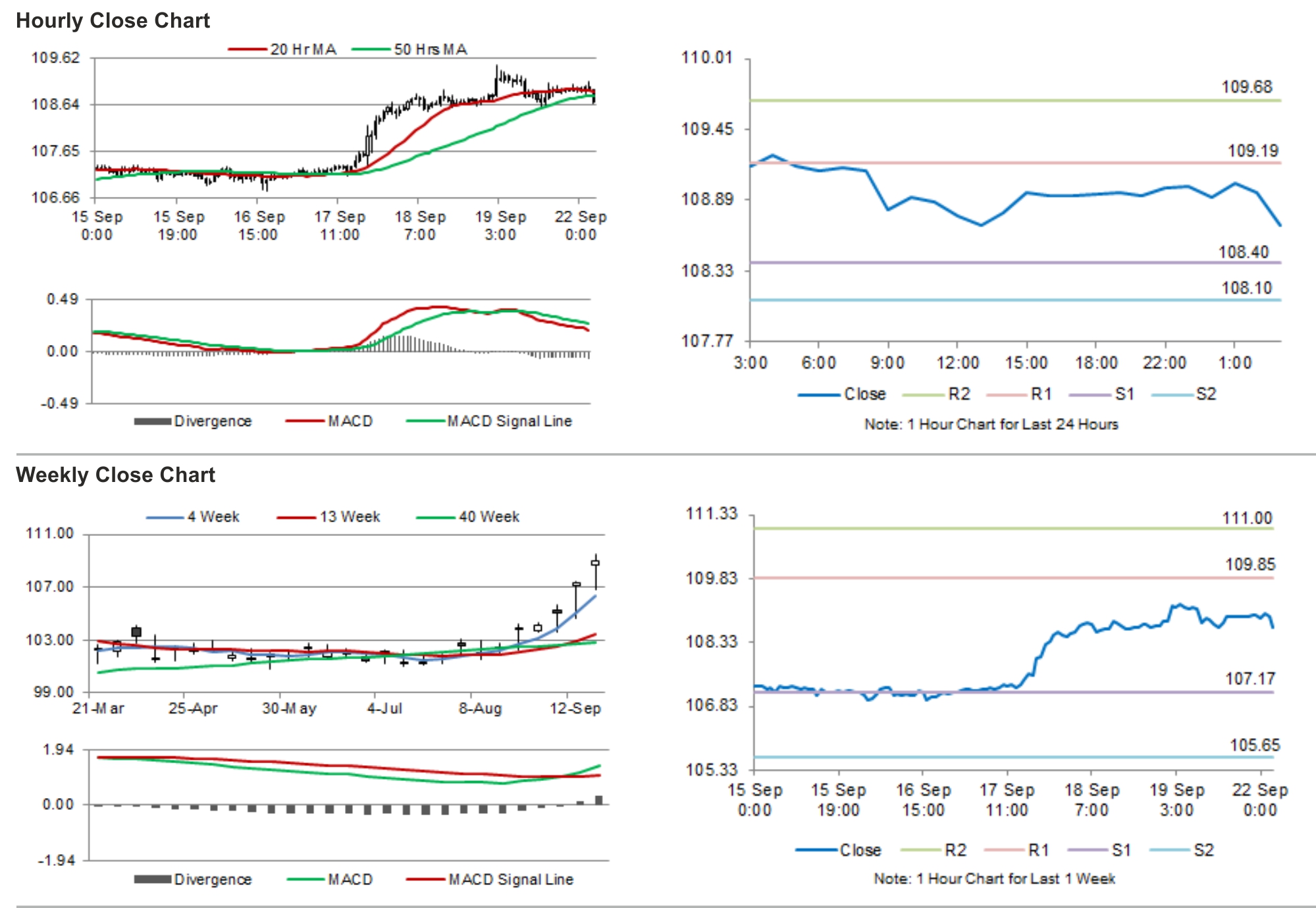

The pair is expected to find support at 108.4, and a fall through could take it to the next support level of 108.1. The pair is expected to find its first resistance at 109.19, and a rise through could take it to the next resistance level of 109.68.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.