For the 24 hours to 23:00 GMT, USD weakened 0.79% against the JPY and closed at 81.58.

In Japan, yesterday, the Bank of Japan (BoJ) held the benchmark interest rate at a range of zero to 0.1% and also kept unchanged ¥30 trillion credit program and ¥10 trillion asset-purchase fund.

Also, BoJ yesterday downgraded the country’s economic growth forecast for 2011 to 0.6% from 1.6%, amid the aftermath of the twin disasters in March. Meanwhile, the construction orders fell 11.0% (Y-o-Y) to Y2.0 trillion in March followed by 19.5% rise in February. Additionally, housing starts index, on yearly basis, dropped by 2.48% during the month of March, compared with a prior increasing 10.1% in February. Annualized housing starts recorded 0.807 million unit during the year ended March, compared with a previous 0.872 million unit a year earlier.

In the Asian session at 3:00GMT, the pair is trading lower from the New York close, by 0.06%, at 81.53.

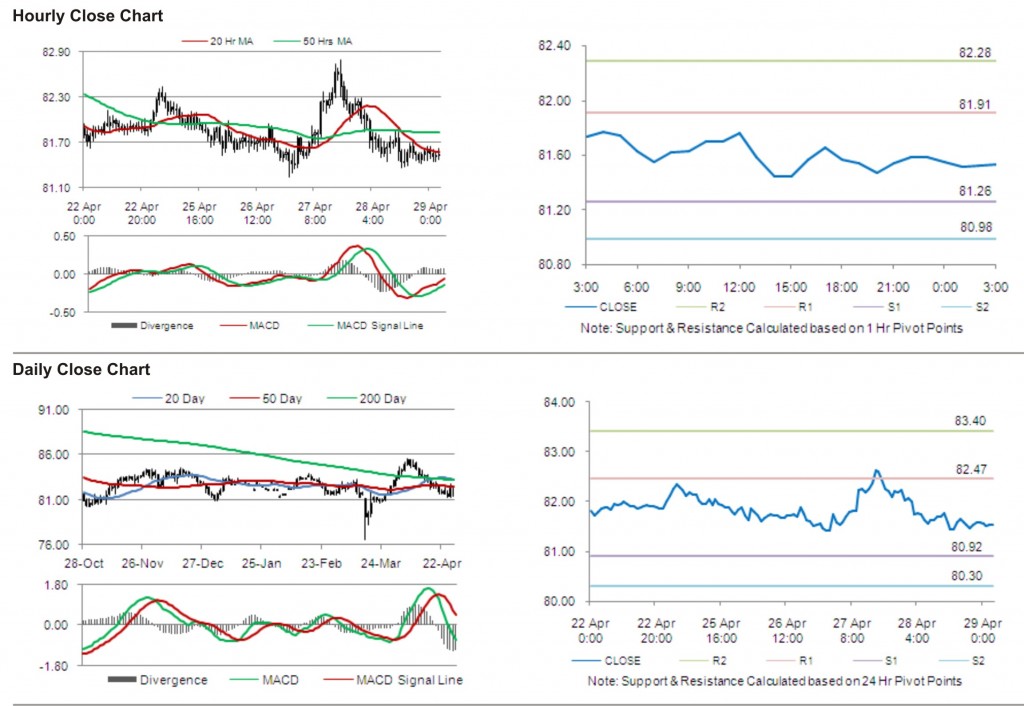

The first short term resistance is at 81.91, followed by 82.28. The pair is expected to find support at 81.26 and the subsequent support level at 80.98.

The currency pair is showing convergence with its 20 Hr moving average and is trading just below its 50 Hr moving average.