For the 24 hours to 23:00 GMT, the USD strengthened 0.49% against the JPY and closed at 123.38.

Yesterday, the BoJ’s monthly report on recent economic and financial development stated that the Japanese economy would continue to recover moderately and pointed that the pace of recovery will be significantly affected by the scenarios of the debt problem in Europe and the momentum of the US economic recovery.

In the Asian session, at GMT0300, the pair is trading at 123.7, with the USD trading 0.26% higher from yesterday’s close.

Earlier today, data released showed that Japan’s preliminary manufacturing PMI fell into contraction territory after the index eased to 49.90 in June, lower than market expectations of a drop to a level of 50.50. In the prior month, the manufacturing PMI had recorded a reading of 50.90.

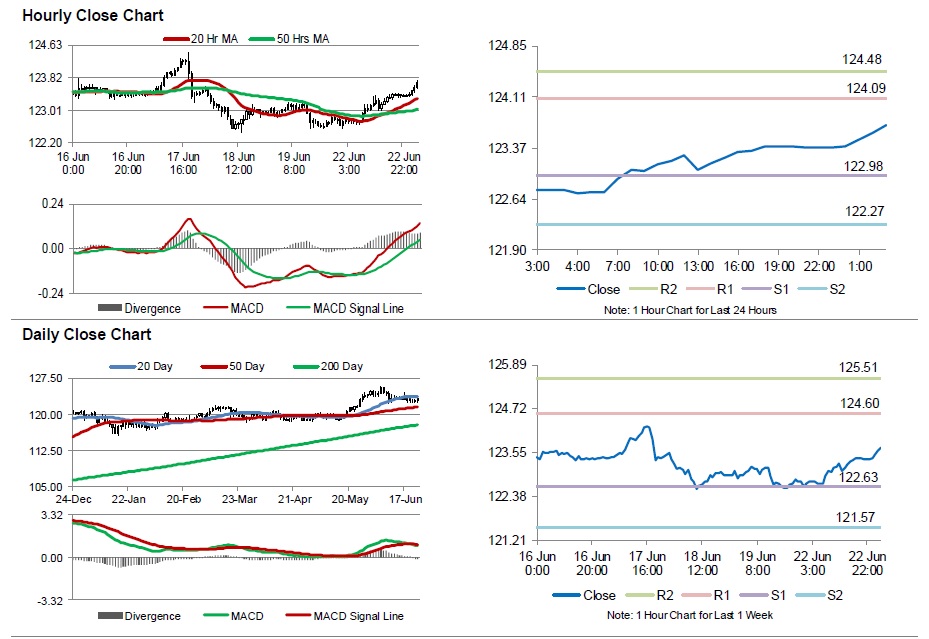

The pair is expected to find support at 122.98, and a fall through could take it to the next support level of 122.27. The pair is expected to find its first resistance at 124.09, and a rise through could take it to the next resistance level of 124.48.

Trading trends in the Yen today are expected to be determined by the BoJ minutes from its recent monetary policy meeting.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.