For the 24 hours to 23:00 GMT, the USD strengthened 0.45% against the JPY and closed at 119.39.

In the Asian session, at GMT0400, the pair is trading at 119.27, with the USD trading 0.09% lower from yesterday’s close.

Overnight data showed that Japan’s national CPI rose 2.4% on an annual basis in January, at par with market expectations and compared to a similar gain registered in February. Meanwhile, the nation’s unemployment rate worsened for the first time in four months to 3.6% in January, from 3.4% registered in the previous month.

In other economic news, preliminary industrial production in Japan climbed more than expected by 4.0% MoM in January, against a gain of 2.7% and following a rise of 0.8% in December, while retail trade retreated 1.3% on a monthly basis in January, compared to a drop of 0.4% registered in the previous month.

Data just released indicated that construction orders in Japan edged up to 27.5% YoY in January and compared to a rise of 7.5% registered in the preceding month, while housing starts eased more than expected by 13.0% compared to a drop of 14.7% recorded in the same period.

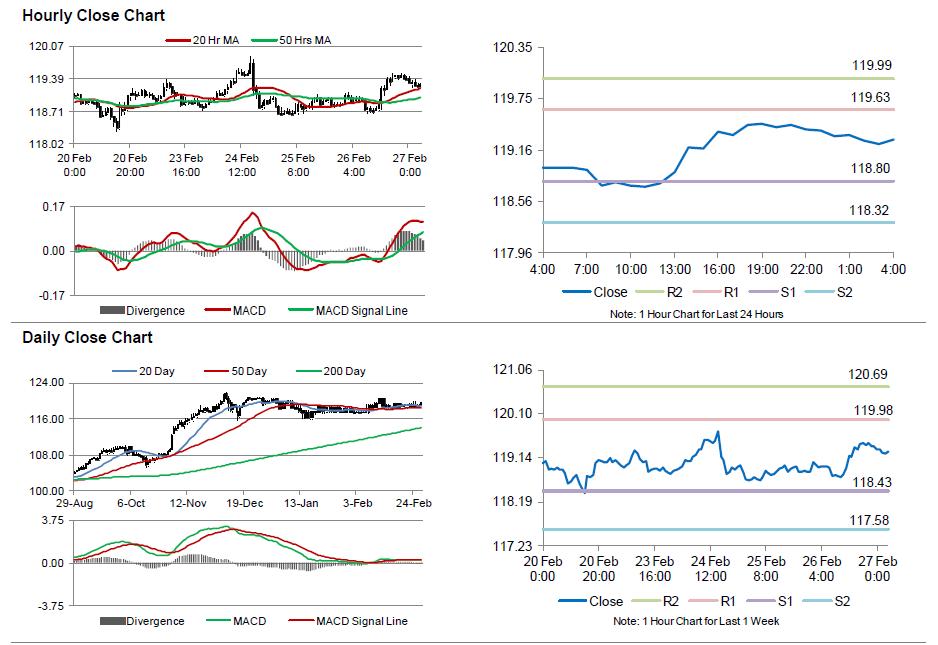

The pair is expected to find support at 118.80, and a fall through could take it to the next support level of 118.32. The pair is expected to find its first resistance at 119.63, and a rise through could take it to the next resistance level of 119.99.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.