On Friday, the USD strengthened 0.34% against the JPY and closed at 104.05.

In economic news, the housing starts in Japan registered a drop of 14.1% in July, on an annual basis, beating market expectations for a fall of 10.5% and compared to a drop of 9.5% in the prior month. However, the construction orders in the nation registered a rise of 24.4% (Y-o-Y) in July, against a rise of 9.3% in the prior month.

In the Asian session, at GMT0300, the pair is trading at 104.17, with the USD trading 0.11% higher from Friday’s close.

Over the weekend, the capital spending in Japan, advanced 3.0% (Q-o-Q) in 2Q 2014, compared to a rise of 7.4% in the previous quarter.

Earlier this morning, data indicated that the final Japanese manufacturing PMI reading eased to a reading of 52.2 in August, compared to a final reading of 52.4 reported in the previous month.

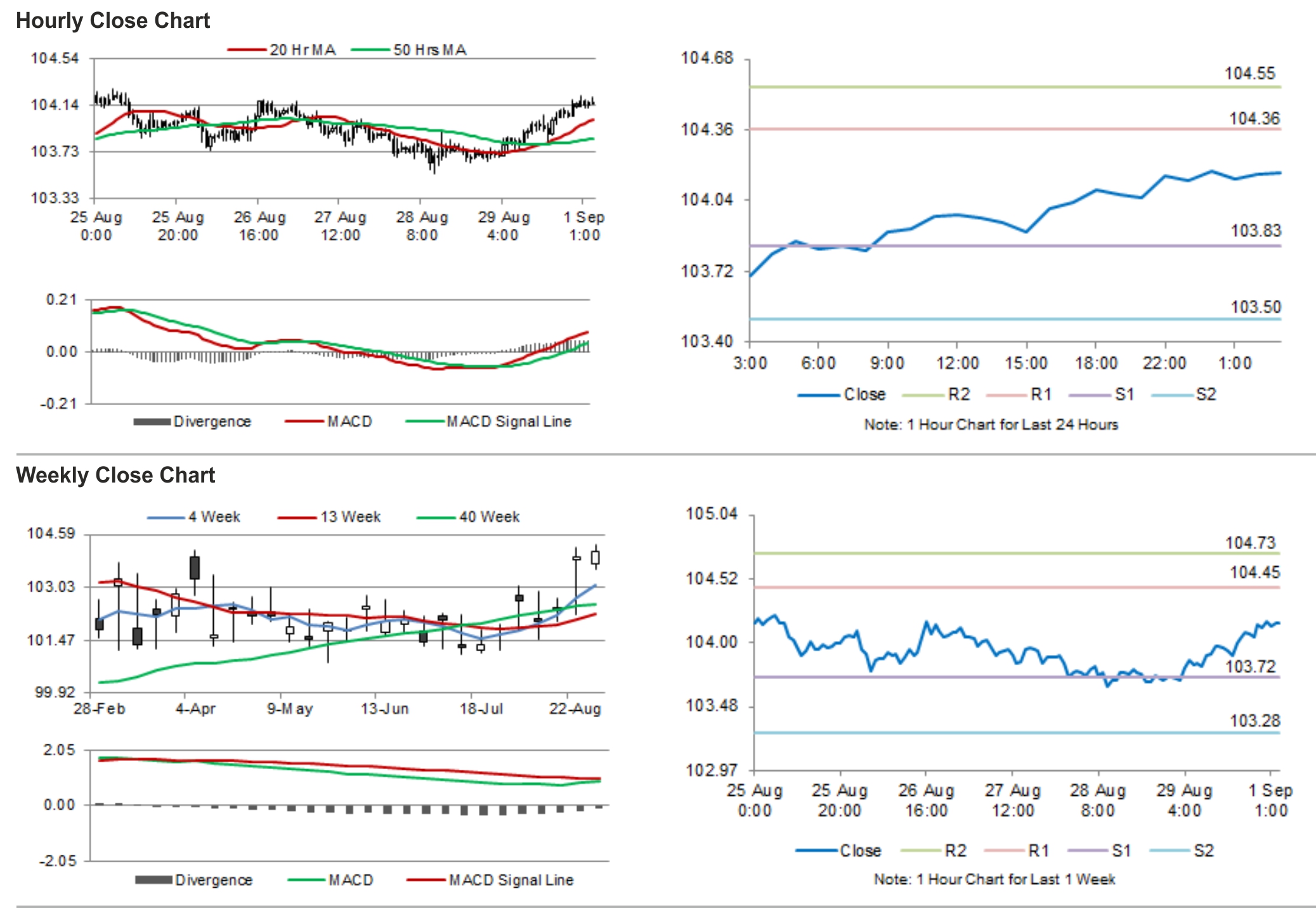

The pair is expected to find support at 103.83, and a fall through could take it to the next support level of 103.50. The pair is expected to find its first resistance at 104.36, and a rise through could take it to the next resistance level of 104.55.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.