For the 24 hours to 23:00 GMT, the USD weakened 0.13% against the JPY and closed at 122.41.

In the Asian session, at GMT0300, the pair is trading at 122.46, with the USD trading a tad higher from yesterday’s close.

Earlier today, data revealed that Japan’s manufacturing PMI edged down to 50.1 in June, but stayed in the expansion territory and compared to prior month’s reading of 50.9.

Overnight data indicated that Japan’s Tankan large manufacturing index rose unexpectedly advanced to 15.0 in 2Q 2015, compared to a reading of 12.0 recorded in the previous quarter. Additionally, the Tankan large manufacturing outlook index climbed to 16.0 in 2Q 2015, following a level of 10.00 in the previous quarter. Meanwhile, the Tankan non-manufacturing outlook index climbed to 21.00 in Japan, against market expectations of an advance to a level of 22.00.

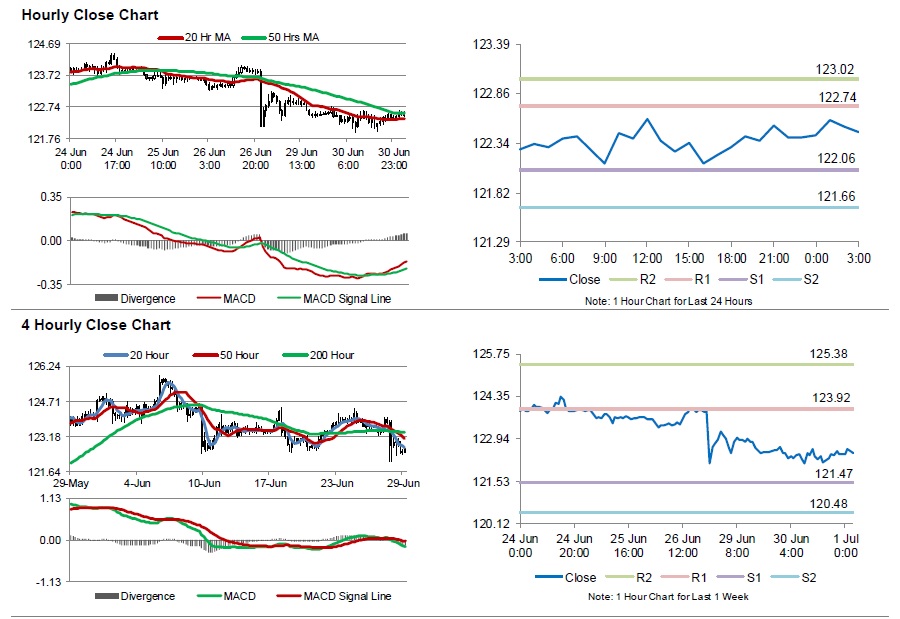

The pair is expected to find support at 122.06, and a fall through could take it to the next support level of 121.66. The pair is expected to find its first resistance at 122.74, and a rise through could take it to the next resistance level of 123.02.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.