For the 24 hours to 23:00 GMT, the USD rose 1.8% against the JPY and closed at 120.94.

The Japanese Yen lost ground, after the BoJ in an unexpected move adopted negative interest rate in a bid to boost the nation’s economy.

In other economic news, housing starts in Japan fell more than expected by 1.3% YoY in December, following a gain of 1.7% in the preceding month and compared to market expectations of a fall to a level of 0.5%. On the other hand, the nation’s construction orders increased by 14.8% on an annual basis in December, from recording a rise of 5.7% in the previous month.

In the Asian session, at GMT0400, the pair is trading at 121.27, with the USD trading 0.27% higher from Friday’s close.

Early morning data indicated that, Japan’s final Nikkei manufacturing PMI slightly fell a level of 52.3 in January, compared to the preliminary figure of 52.4.

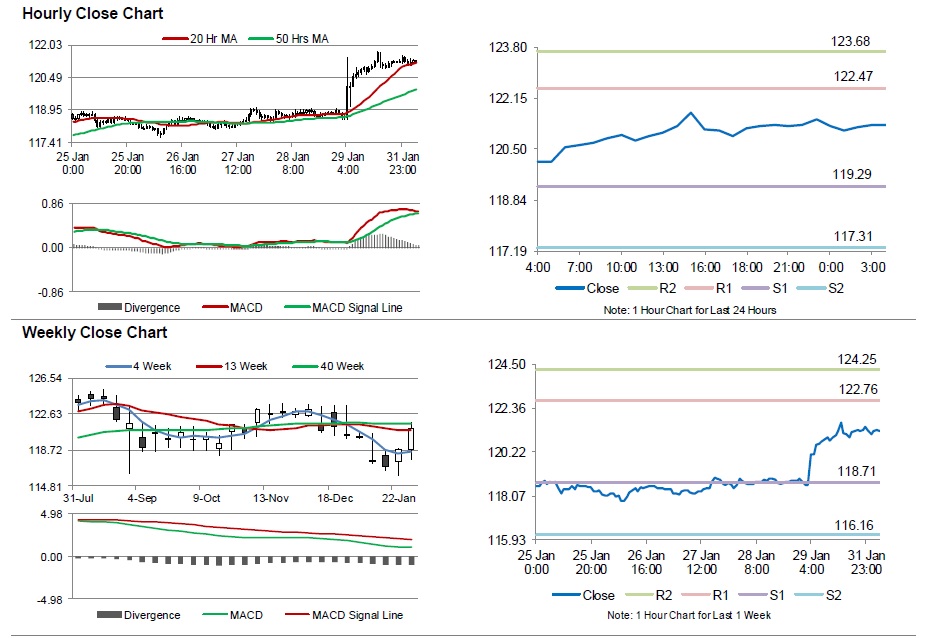

The pair is expected to find support at 119.29, and a fall through could take it to the next support level of 117.31. The pair is expected to find its first resistance at 122.47, and a rise through could take it to the next resistance level of 123.68.

Amid no further macroeconomic releases in Japan today, trading trends in the Yen are expected to be determined by global macroeconomic factors.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.