For the 24 hours to 23:00 GMT, the USD strengthened 0.18% against the JPY and closed at 104.32.

In economic news, the vehicle sales in Japan eased 5.0% on an annual basis, in August, following a 0.6% rise registered in July.

In the Asian session, at GMT0300, the pair is trading at 104.76, with the USD trading 0.42% higher from yesterday’s close.

Early morning data indicated that the labour cash earnings in Japan had risen 2.6% in July, compared to a revised 1.0% rise in the previous month, while markets were expecting it to rise 0.9% in July. Meanwhile, the monetary base in Japan advanced 40.5%, on an annual basis, in August, compared to a rise of 42.7% registered in the prior month.

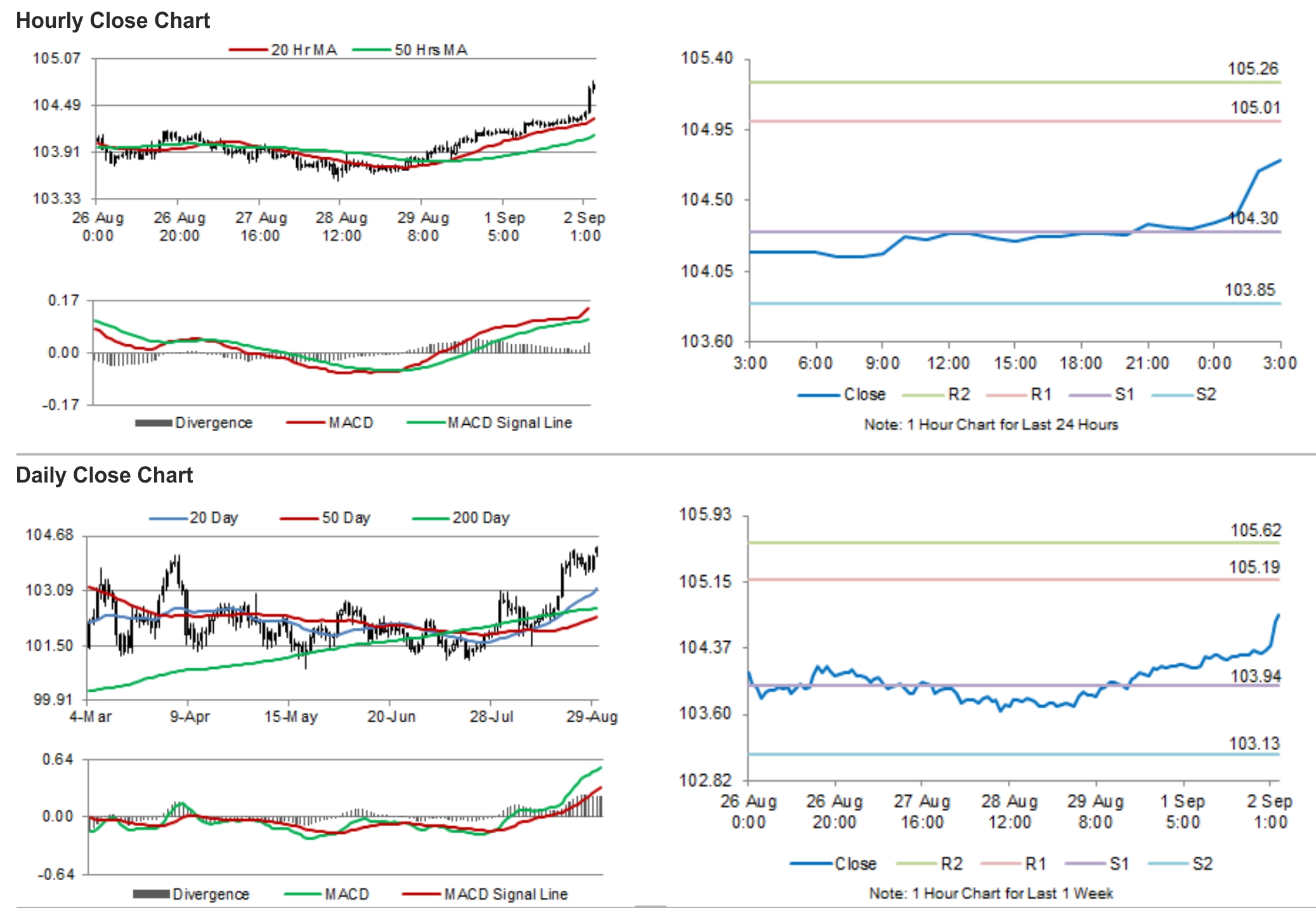

The pair is expected to find support at 104.3, and a fall through could take it to the next support level of 103.85. The pair is expected to find its first resistance at 105.01, and a rise through could take it to the next resistance level of 105.26.

Going forward, investors await services PMI data from Japan, scheduled to release early tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.