For the 24 hours to 23:00 GMT, the USD strengthened 0.09% against the JPY and closed at 119.92.

In economic news, Japan’s housing starts increased more than expected by 8.8% YoY in August, highlighting its sixth consecutive rise.

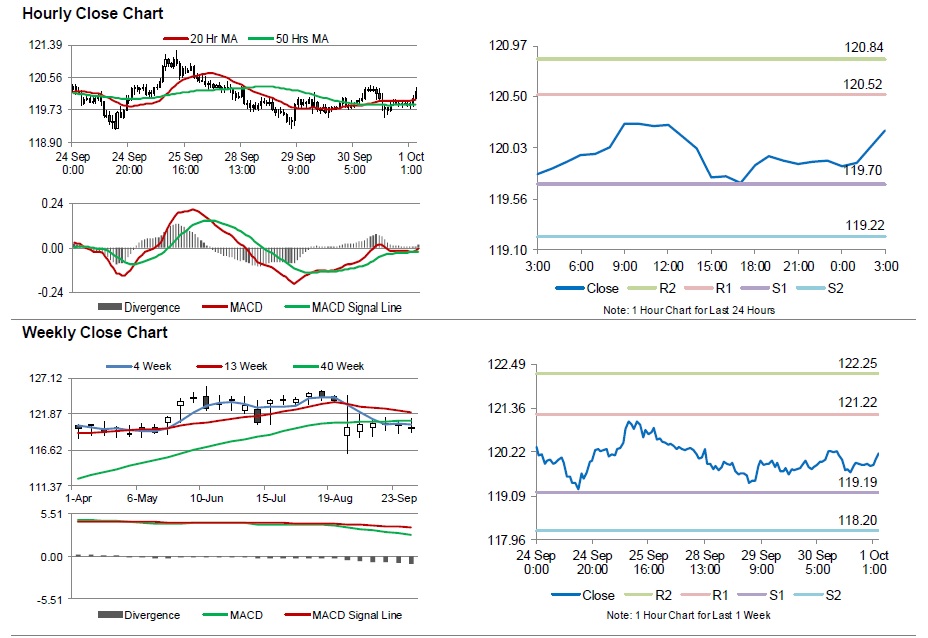

In the Asian session, at GMT0300, the pair is trading at 120.19, with the USD trading 0.23% higher from yesterday’s close.

Overnight data showed that Tankan large manufacturing index for Q3 fell more than expected to 12 points, while the large manufacturing outlook fell to 10, in-line with expectations in Q2. Meanwhile, the non-manufacturing outlook came in above forecasts at 19 in Q3, while the non-manufacturing index rose more than expected to a level of 25 in Q3.

This morning, data revealed that Japan’s final manufacturing PMI index rose to 51.0 in September, from its preliminary figure of 50.9.

The pair is expected to find support at 119.70, and a fall through could take it to the next support level of 119.22. The pair is expected to find its first resistance at 120.52, and a rise through could take it to the next resistance level of 120.84.

Going ahead, market participants await the release of Japan’s jobless rate and household spending data, both for the month of August, scheduled tonight.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.