For the 24 hours to 23:00 GMT, the USD weakened 0.58% against the JPY and closed at 102.55.

In economic news, Japan’s consumer confidence index advanced above expectations to a five-month high level of 41.8 in June, from a reading of 40.9 in the previous month.

In the Asian session, at GMT0300, the pair is trading at 102.71, with the USD trading 0.16% higher against the JPY from Friday’s close.

Overnight data showed that, Japan’s monetary base rose 25.4% YoY in June, advancing for the seventh straight month, compared to a 25.5% increase in the previous month.

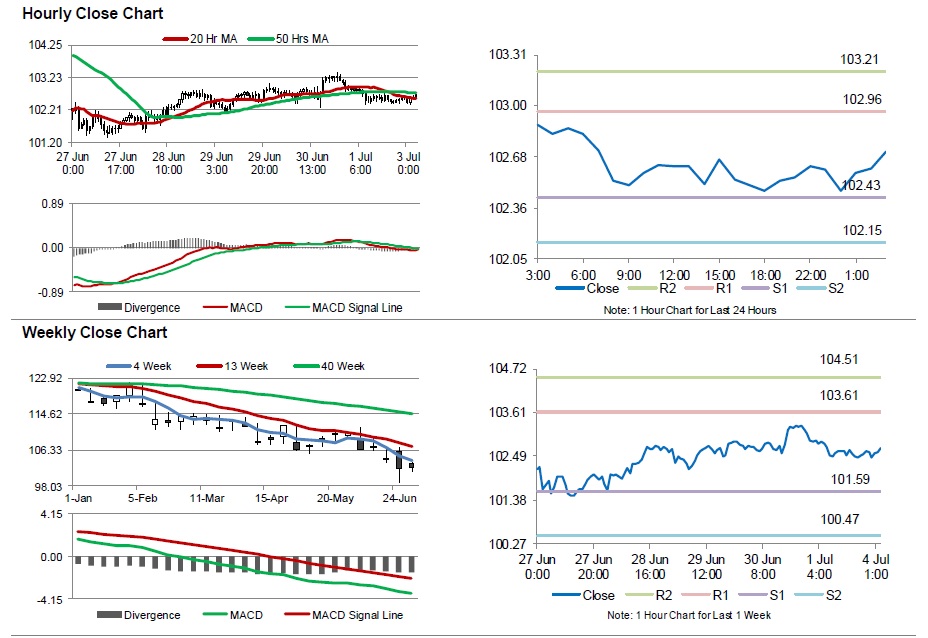

The pair is expected to find support at 102.43, and a fall through could take it to the next support level of 102.15. The pair is expected to find its first resistance at 102.96, and a rise through could take it to the next resistance level of 103.21.

Going ahead, market participants await the release of Japan’s Nikkei services PMI data for June, due in the early hours tomorrow.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.