For the 24 hours to 23:00 GMT, the USD declined 0.18% against the JPY and closed at 113.68 on Friday.

On the macro front, Japan’s leading economic index rose to a level of 104.4 in August, compared to a level of 103.9 in the previous month. Moreover, the flash coincident index climbed to a level of 117.5 in August, compared to a reading of 116.1 in the prior month.

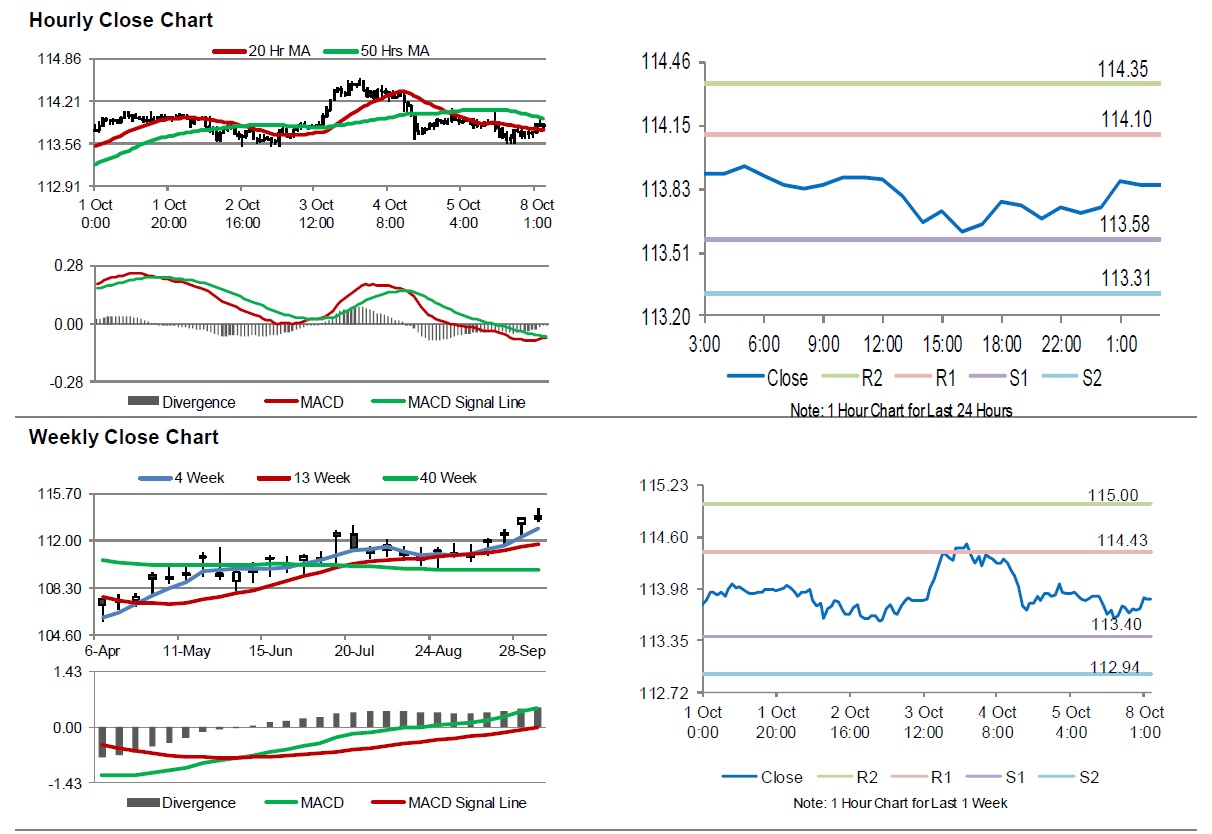

In the Asian session, at GMT0300, the pair is trading at 113.85, with the USD trading 0.15% higher against the JPY from Friday’s close.

The pair is expected to find support at 113.58, and a fall through could take it to the next support level of 113.31. The pair is expected to find its first resistance at 114.10, and a rise through could take it to the next resistance level of 114.35.

Going ahead, traders would look forward to Japan’s trade balance (BOP basis) data for August slated to release overnight.

The currency pair is showing convergence with its 20 Hr moving average and trading below its and 50 Hr moving average.