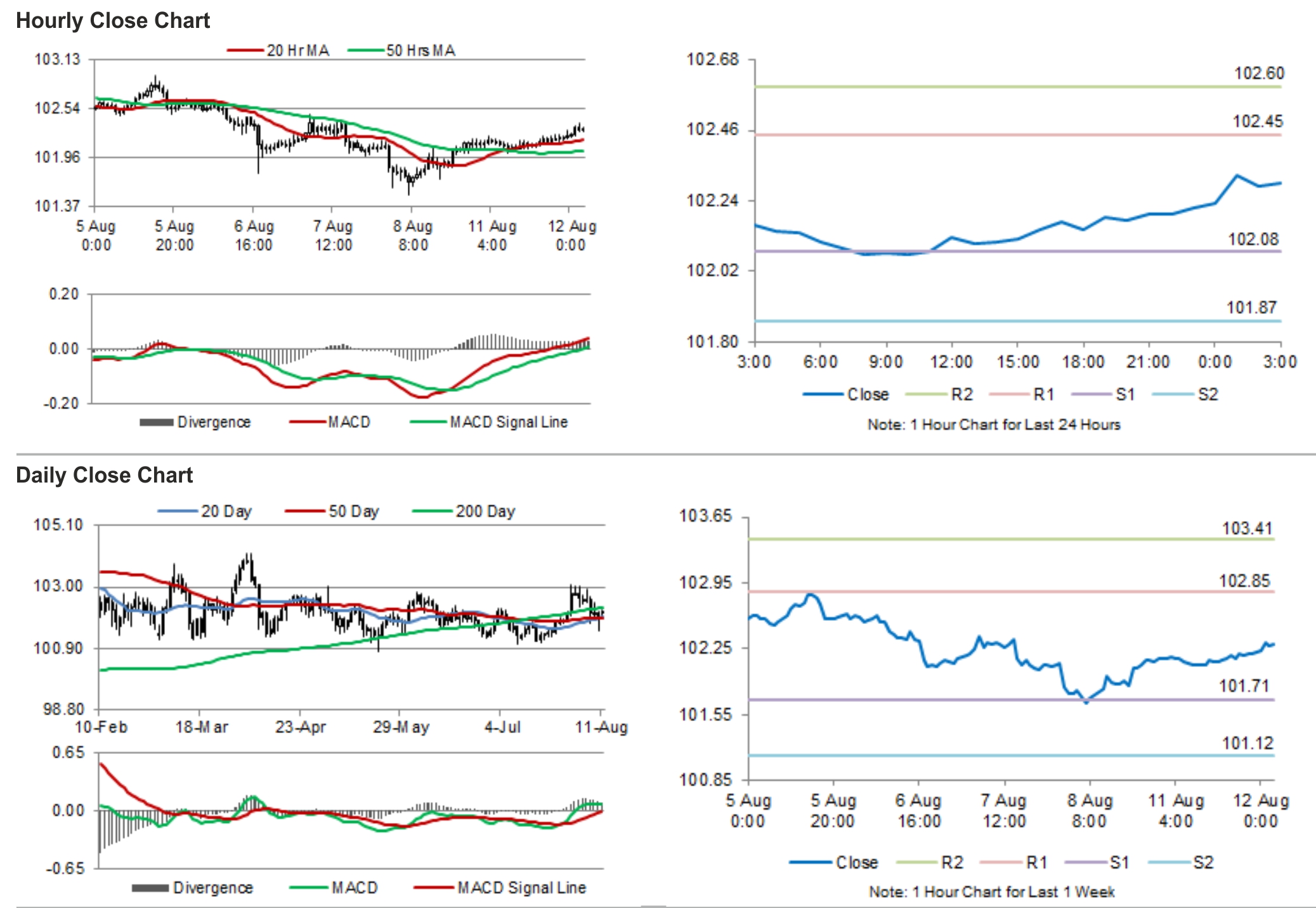

For the 24 hours to 23:00 GMT, the USD strengthened 0.10% against the JPY and closed at 102.22.

In economic news, the consumer confidence in Japan rose for the third consecutive month in July after the index advanced to 41.5 in July, compared to a level of 41.1 in June. Meanwhile, the BoJ, in its monthly economic survey, reported that the Japanese economy would continue its moderate economic growth as the impact of the recent sales tax hike effect would fade away gradually. Further, it added that the export condition of the nation is a bit sluggish at this moment and is likely to taste a moderate increase with time.

In the Asian session, at GMT0300, the pair is trading at 102.3, with the USD trading 0.08% higher from yesterday’s close.

Early this morning, the domestic corporate goods price index in Japan rose for the 16th straight time, as it climbed 4.3% in July, on a yearly basis, compared to an advance of 4.6% in the previous month. Market expectations were for it were to climb 4.4%.

The pair is expected to find support at 102.08, and a fall through could take it to the next support level of 101.87. The pair is expected to find its first resistance at 102.45, and a rise through could take it to the next resistance level of 102.60.

All eyes are set on the release of BoJ minutes as well as Japan Q2 GDP numbers, to be out in the midnight.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.