For the 24 hours to 23:00 GMT, the USD weakened 0.19% against the JPY and closed at 106.44.

In economic news, Japan’s final Nikkei manufacturing PMI dropped to a three-year low level of 48.2 in April, compared to a reading of 49.1 in the previous month. The preliminary figure had recorded a level of 48.0.

Separately, the BoJ Governor, Haruhiko Kuroda, warned that the Japanese Yen’s recent rise could hurt the world’s third largest economy. Further, he reiterated that the central bank would not hesitate to implement additional monetary policy action if needed to achieve its 2% price target.

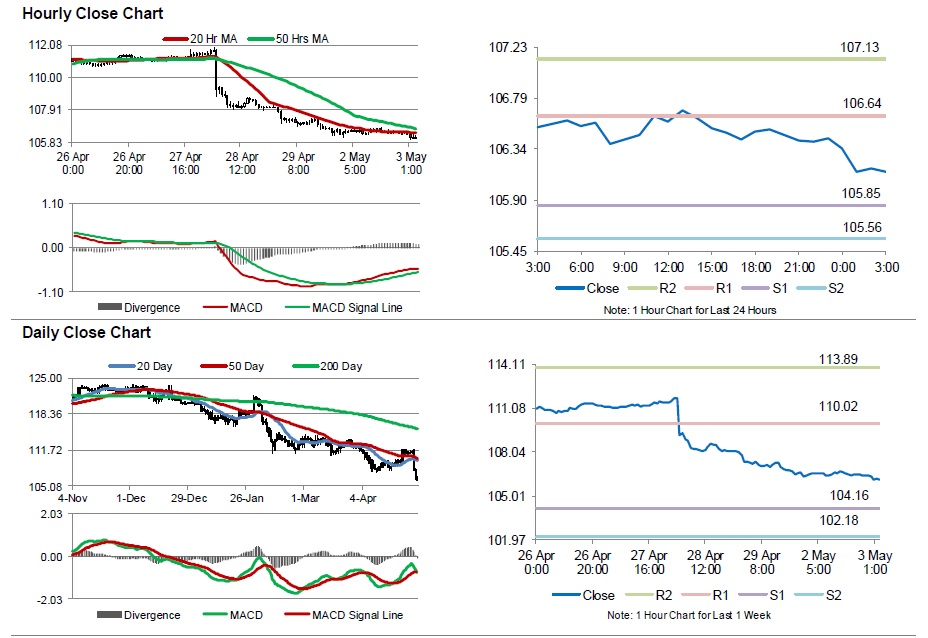

In the Asian session, at GMT0300, the pair is trading at 106.15, with the USD trading 0.27% lower from yesterday’s close.

The pair is expected to find support at 105.85, and a fall through could take it to the next support level of 105.56. The pair is expected to find its first resistance at 106.64, and a rise through could take it to the next resistance level of 107.13.

Amid no economic releases in Japan today, investor sentiment would be governed by global macroeconomic news.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.