For the 24 hours to 23:00 GMT, the USD declined 0.52% against the JPY and closed at 101.90.

On the data front, Japan’s preliminary machine tool orders dropped by 19.6% on an annual basis in July, following a drop of 19.9% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 101.32, with the USD trading 0.57% lower against the JPY from yesterday’s close.

Overnight data indicated that, Japan’s machinery orders rebounded more-than-expected by 8.3% in June, compared to market expectations for a rise of 3.2% and after recording a drop of 1.4% in the prior month.

Earlier today, data revealed that Japan’s tertiary industry index rebounded more-than-estimated by 0.8% MoM in June. Markets expected the index to rise by 0.3%, following a drop of 0.7% in the preceding month.

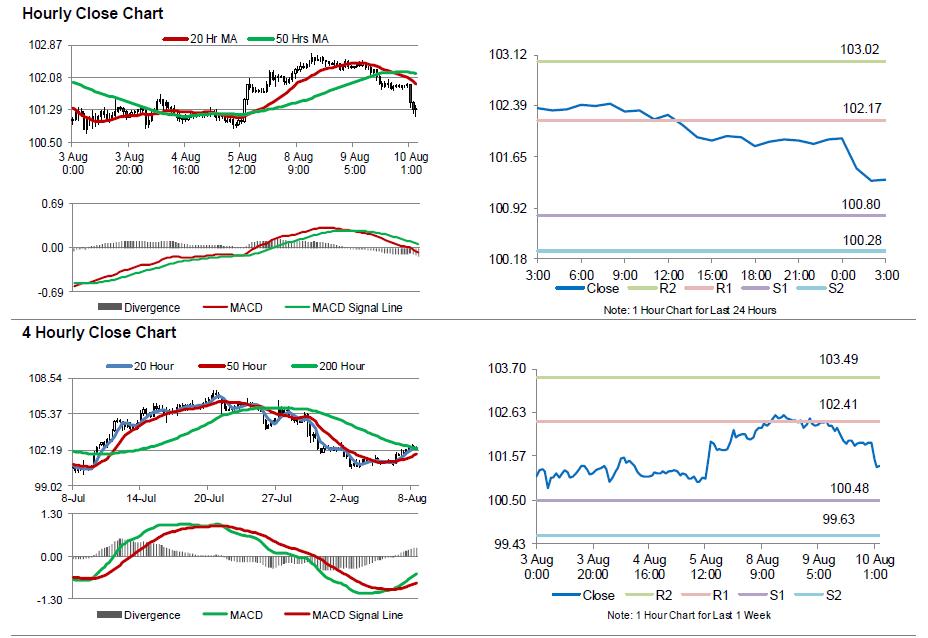

The pair is expected to find support at 100.8, and a fall through could take it to the next support level of 100.28. The pair is expected to find its first resistance at 102.17, and a rise through could take it to the next resistance level of 103.02.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.