For the 24 hours to 23:00 GMT, the USD weakened 0.35% against the JPY and closed at 117.93.

Yesterday, the BoJ Governor, Haruhiko Kuroda, urged business leaders to use profits more productively by boosting investments in facilities and jobs, taking advantage of a weaker yen. He further reiterated that the central bank would continue to adjust its unprecedented easing policy as needed to achieve its inflation goal.

In the Asian session, at GMT0400, the pair is trading at 117.84, with the USD trading 0.08% lower from yesterday’s close.

Early this morning, the BoJ’s Board Member, Sayuri Shirai mentioned that additional stimulus was required so that the central bank attain its 2% inflation goal in the future.

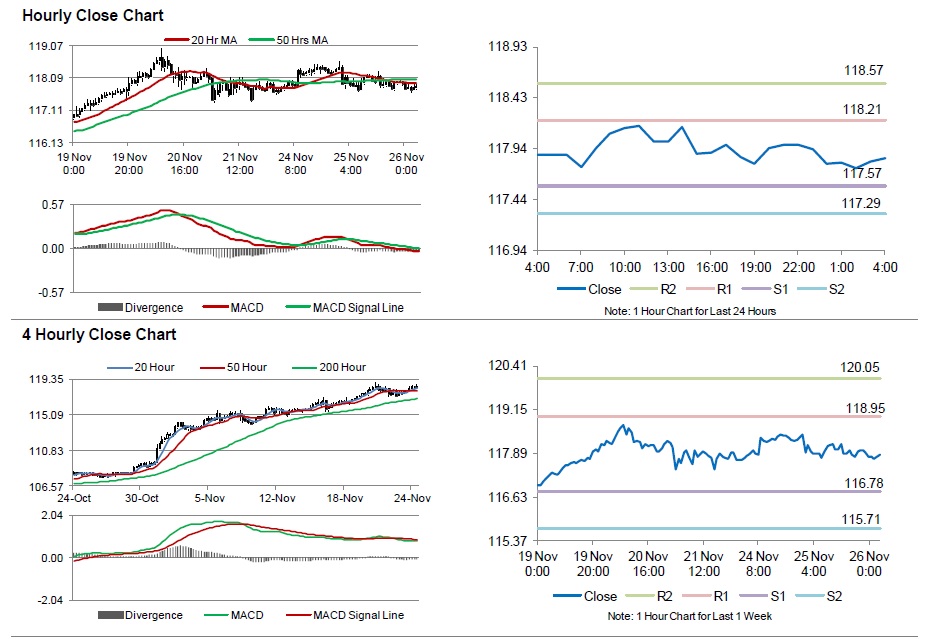

The pair is expected to find support at 117.57, and a fall through could take it to the next support level of 117.29. The pair is expected to find its first resistance at 118.21, and a rise through could take it to the next resistance level of 118.57.

Going forward, investors look forward to Japan’s national CPI couple with the nation unemployment rate data, scheduled in the late hours tomorrow.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.