For the 24 hours to 23:00 GMT, the USD slightly declined against the JPY and closed at 111.33.

On the data front, Japan’s final machine tool orders climbed 24.5% YoY in May, compared to a gain of 24.4% recorded in the preliminary figures. In the prior month, machine tool orders had registered a rise of 34.7%.

Meanwhile, the Bank of Japan (BoJ) Governor, Haruhiko Kuroda, reiterated that it is wise to stick to the central bank’s current monetary policy stance as inflation pressures in the economy remain stubbornly low.

In the Asian session, at GMT0300, the pair is trading at 111.04, with the USD trading 0.26% lower against the JPY from yesterday’s close.

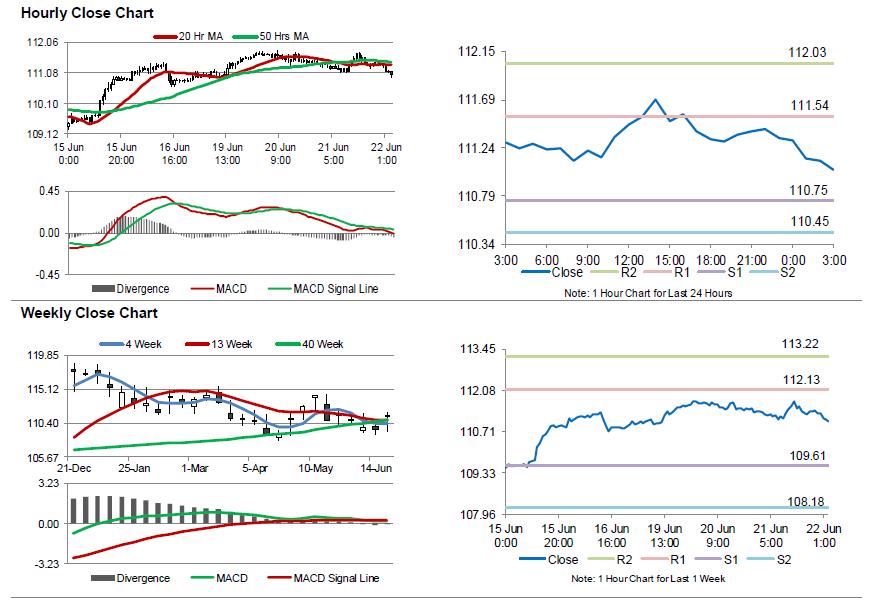

The pair is expected to find support at 110.75, and a fall through could take it to the next support level of 110.45. The pair is expected to find its first resistance at 111.54, and a rise through could take it to the next resistance level of 112.03.

Looking ahead, investors will closely monitor Japan’s flash Nikkei manufacturing PMI for June, slated to release overnight.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.