For the 24 hours to 23:00 GMT, the USD rose 0.43% against the JPY and closed at 100.80.

On the data front, Japan’s small business confidence index rose to a level of 47.7 in September, beating market expectations for a rise to a level of 47.0 and after recording a reading of 46.3 in the prior month.

In the Asian session, at GMT0300, the pair is trading at 101.35, with the USD trading 0.55% higher against the JPY from yesterday’s close.

Overnight data indicated that, Japan’s seasonally adjusted retail trade declined more-than-expected by 1.1% on a monthly basis in August, declining for the sixth straight month, compared to a revised advance of 1.5% in the prior month whereas markets expected it to ease by 0.8%. Moreover, the nation’s large retailer’s sales eased more-than-anticipated by 3.6% in August, following a revised gain of 0.6% in the prior month.

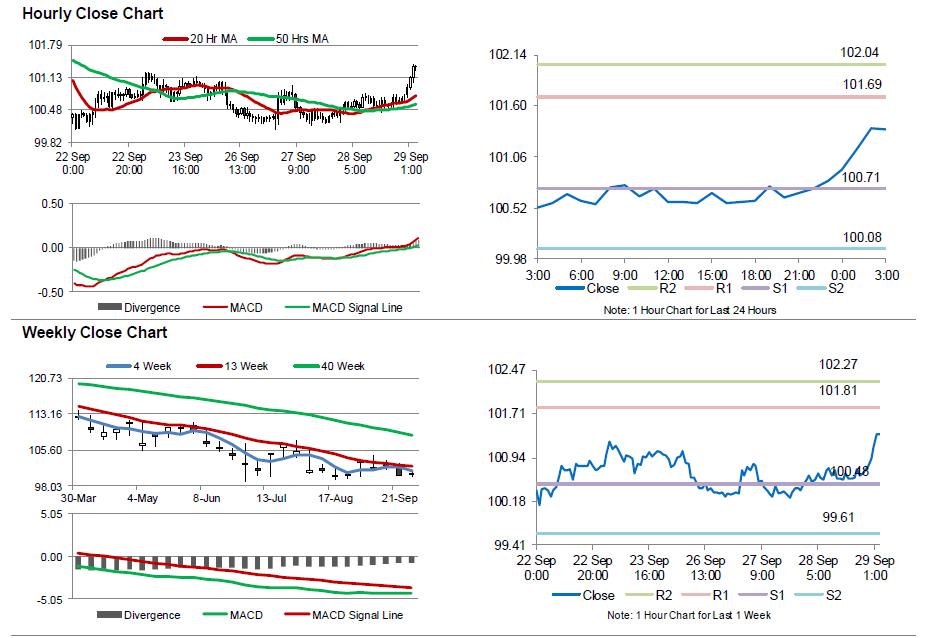

The pair is expected to find support at 100.71, and a fall through could take it to the next support level of 100.08. The pair is expected to find its first resistance at 101.69, and a rise through could take it to the next resistance level of 102.04.

Investors would turn all their attention to the BoJ Governor, Haruhiko Kuroda’s speech, due in some time. Additionally, Japan’s unemployment rate, national consumer price index and flash industrial production data for August, all slated to release overnight, would keep investors on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.