For the 24 hours to 23:00 GMT, the USD weakened 0.92% against the JPY and closed at 120.23, after the Fed downgraded the economic growth as well as the inflation outlook of the US.

Yesterday, the BoJ in its latest monthly report indicated that the nation’s economy continued to recover moderately on the back of gradually rising business fixed investment as corporate profits improved. Additionally, the report stated that the nation’s economy was anticipated to continue its moderate recovery with adequate rise in exports mainly against the background of the recovery in overseas economies.

In the Asian session, at GMT0400, the pair is trading at 120.42, with the USD trading 0.16% higher from yesterday’s close.

Earlier today, the all industry activity index in Japan advanced 1.90% on a monthly basis in January, in line with market expectations. In the prior month, it had fallen by a revised 0.10%.

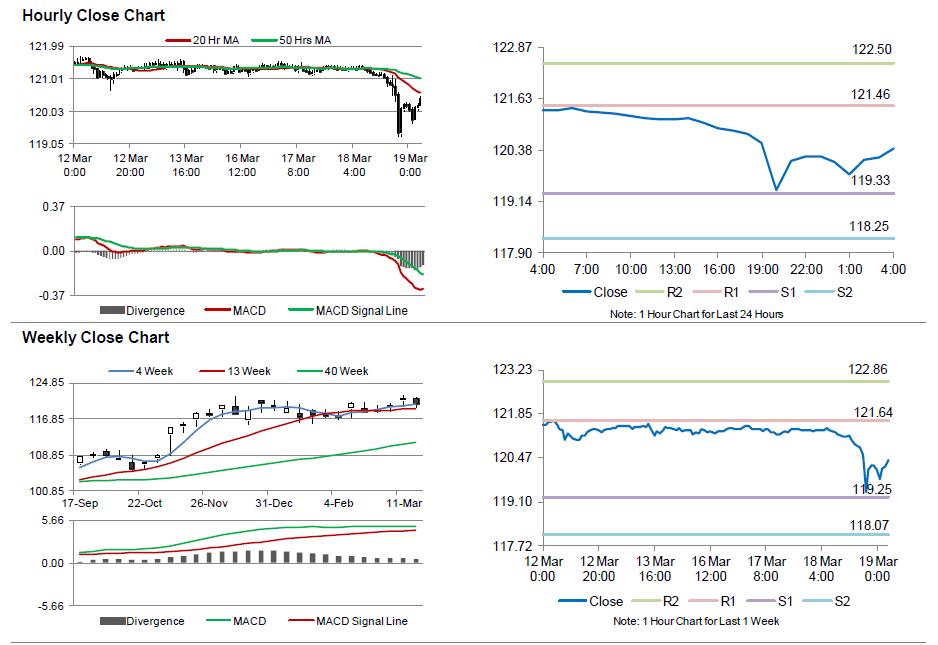

The pair is expected to find support at 119.33, and a fall through could take it to the next support level of 118.25. The pair is expected to find its first resistance at 121.46, and a rise through could take it to the next resistance level of 122.50.

Trading trends in the Yen today are expected to be determined by the BoJ minutes from its recent monetary policy meeting, scheduled overnight.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.