For the 24 hours to 23:00 GMT, the USD traded flat against the JPY and closed at 121.55.

In the Asian session, at GMT0300, the pair is trading at 121.76, with the USD trading 0.18% higher from yesterday’s close.

Over the weekend, data indicated that Japan’s exports climbed 8.0% on an annual basis in March, topping market expectations for a 6.4% rise, albeit slowing from an 8.5% gain registered in March. Meanwhile, adjusted merchandise trade deficit stood at ¥208.70 billion in April. The nation had registered a revised adjusted merchandise trade surplus of ¥5.00 billion in the previous month.

Separately, the BoJ Governor, Haruhiko Kuroda stated that the central bank expects inflation rate to start gathering pace in the second half of this fiscal year and reach around 2.0% in or around the first half of the next fiscal year. Further, he opined that at present he does not foresee any necessity of additional monetary policy easing.

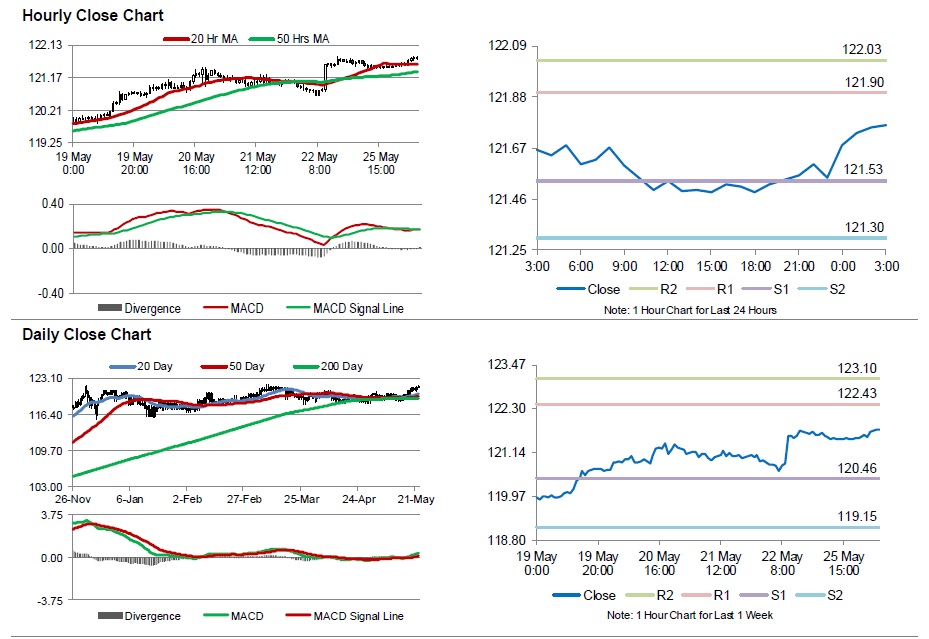

The pair is expected to find support at 121.53, and a fall through could take it to the next support level of 121.3. The pair is expected to find its first resistance at 121.9, and a rise through could take it to the next resistance level of 122.03.

Meanwhile, traders look forward to the release of the BoJ minutes from its latest monetary policy meeting, scheduled overnight.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.