For the 24 hours to 23:00 GMT, the USD weakened 0.53% against the JPY and closed at 122.92.

Yesterday, the BoJ Governor, Haruhiko Kuroda, downplayed concerns about the nation’s third quarter contraction and stated that the nation’s business capital expenditure is likely to improve.

In other economic news, Japan’s final machine tool orders fell 22.9% YoY in October, after declining by 19.1% in the previous month. The preliminary figures had indicated a drop of 23.1%.

In the Asian session, at GMT0400, the pair is trading at 122.94, with the USD trading marginally higher from yesterday’s close.

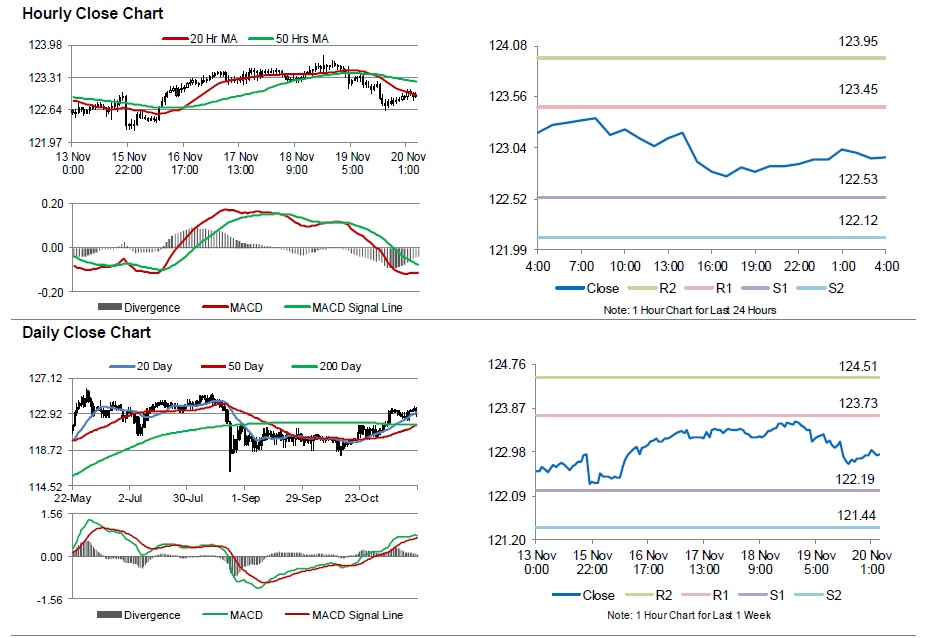

The pair is expected to find support at 122.53, and a fall through could take it to the next support level of 122.12. The pair is expected to find its first resistance at 123.45, and a rise through could take it to the next resistance level of 123.95.

Moving ahead, investors will look forward to Japan’s Nikkei manufacturing PMI, national consumer price inflation, unemployment rate data and the BoJ’s October meeting minutes, all scheduled to be released next week.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.