For the 24 hours to 23:00 GMT, the USD strengthened 0.51% against the JPY and closed at 119.50.

Yesterday, data showed that Japan’s preliminary leading economic index fell less than expected to a level of 105.30 in February, compared to a reading of 105.50 in January. On the other hand, the nation’s coincident index dropped more than expected to 110.50 in February, following a reading of 113.30 recorded in the previous month.

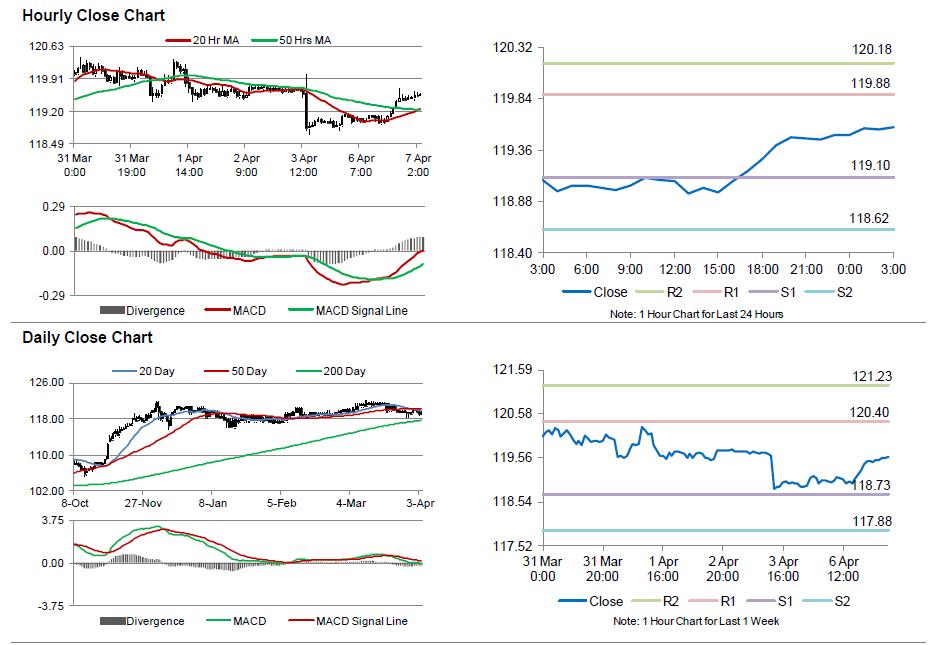

In the Asian session, at GMT0300, the pair is trading at 119.58, with the USD trading 0.07% higher from yesterday’s close.

Overnight data showed that foreign reserves in Japan narrowed to a level of $1245.30 billion in March. In the previous month, it recorded a level of $1251.10 billion.

The pair is expected to find support at 119.10, and a fall through could take it to the next support level of 118.62. The pair is expected to find its first resistance at 119.88, and a rise through could take it to the next resistance level of 120.18.

Looking ahead, investors would keep a close eye on the BoJ’s monetary policy statement, followed by the central bank Governor, Haruhiko Kuroda’s speech, scheduled tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.