For the 24 hours to 23:00 GMT, the USD strengthened 0.91% against the JPY and closed at 115.89. The Japanese currency lost ground, after Japan’s Eco Watchers Survey index for current situation fell more than expected to a level of 44.0 in October, against market expectations of a reading of 47.2 and compared to 47.4 recorded in the prior month.

In other economic data, Japan’s Eco Watchers Survey index for future outlook dropped to 46.6 in October, following a level of 48.7 registered in the prior month. Meanwhile, the nation’s annual machine tool orders data rose 31.2% in October, less than preceding month’s gain of 34.7%.

In the Asian session, at GMT0400, the pair is trading at 115.8, with the USD trading 0.08% lower from yesterday’s close.

Earlier today, the BoJ Board Member Ryuzo Miyao stated that the central bank could start discussing about winding up its ultra-loose monetary policy in the second half of fiscal 2015, as the recent stimulus expansion decision had increased the probability of the BoJ meeting its 2% inflation target.

Overnight data indicated that, Japan’s tertiary industry index rebounded 1.0% on a monthly basis in September, following a drop of 0.1% recorded in the previous month, while markets were expecting it to advance 0.8%.

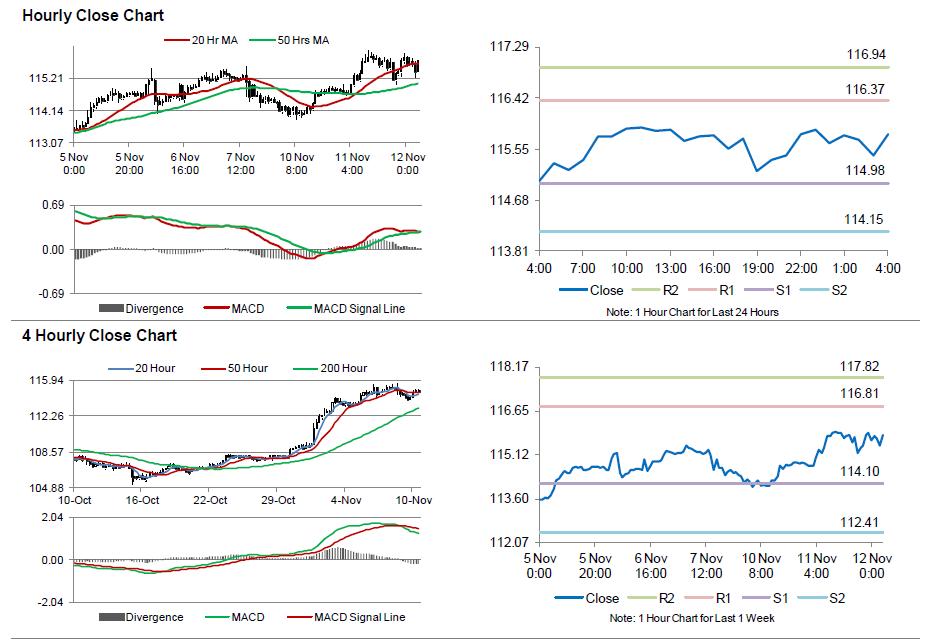

The pair is expected to find support at 114.98, and a fall through could take it to the next support level of 114.15. The pair is expected to find its first resistance at 116.37, and a rise through could take it to the next resistance level of 116.94.

Going forward, investors look forward to Japan’s annual machine orders data for further cues, scheduled overnight.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.