For the 24 hours to 23:00 GMT, the USD declined 0.15% against the JPY and closed at 112.65 on Friday.

On the economic front, Japan’s flash leading economic index climbed less-than-expected to a level of 106.8 in August, compared to a reading of 105.2 in the prior month. Market participants had anticipated for a rise to a level of 107.1. Meanwhile, the nation’s preliminary coincident index rose to a level of 117.6 in August, beating market expectations of an advance to a level of 117.5. The index had registered a level of 115.7 in the previous month.

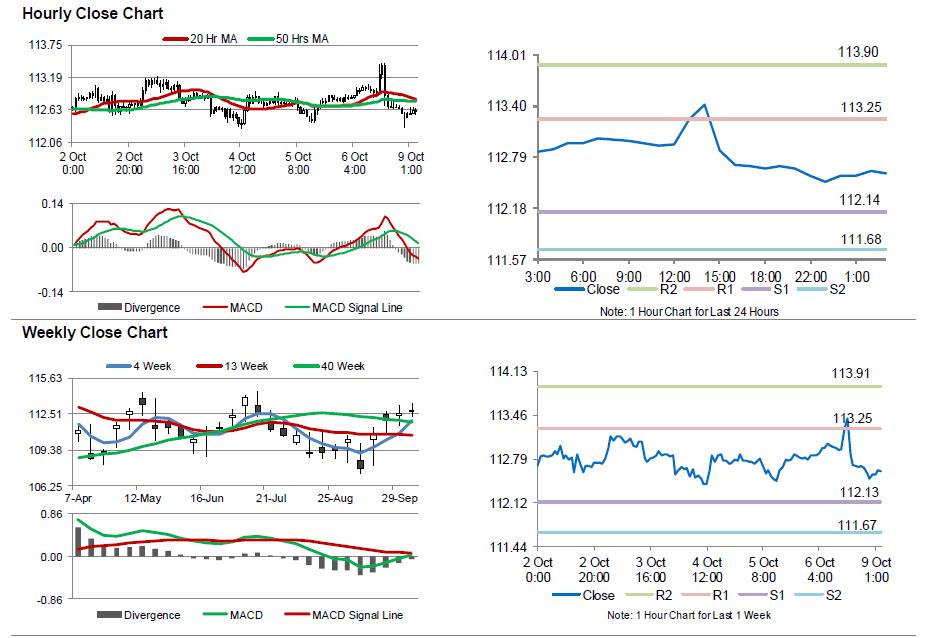

In the Asian session, at GMT0300, the pair is trading at 112.60, with the USD trading marginally lower against the JPY from Friday’s close.

The pair is expected to find support at 112.14, and a fall through could take it to the next support level of 111.68. The pair is expected to find its first resistance at 113.25, and a rise through could take it to the next resistance level of 113.90.

Moving ahead, traders will closely monitor the release of Japan’s trade balance (BOP basis) for August, slated overnight and the Eco-Watchers survey data for September, slated to release tomorrow.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.