For the 24 hours to 23:00 GMT, the USD rose 1.99% against the JPY and closed at 102.65.

On the data front, Japan’s preliminary machine tool orders fell 19.9% YoY in June, compared to a fall of 24.7% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 102.95, with the USD trading 0.29% higher against the YEN from yesterday’s close.

Earlier today, data indicated that the nation’s tertiary industry index fell by 0.7% in May, in line with market expectations and following a similar revised gain in the previous month.

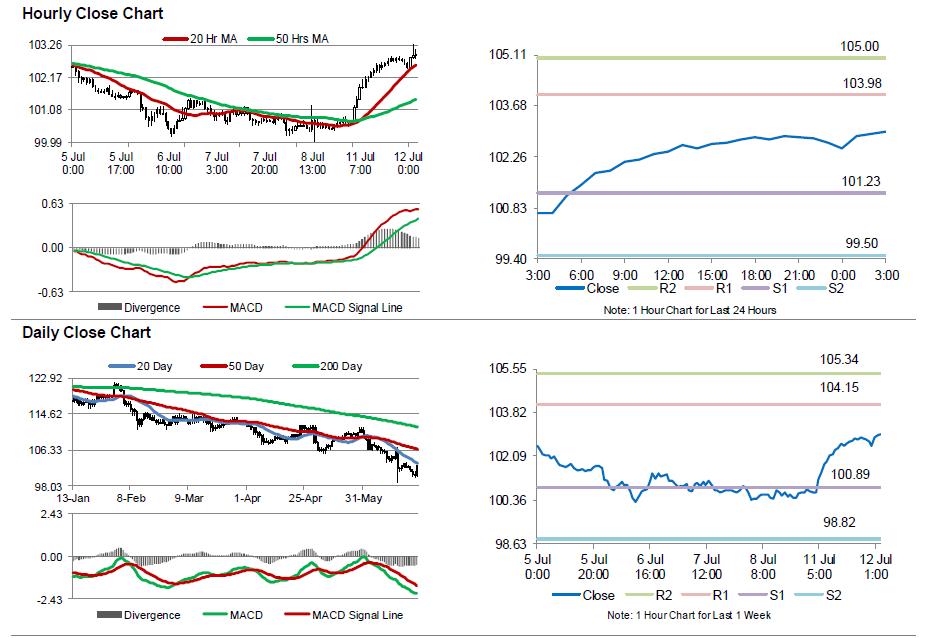

The pair is expected to find support at 101.23, and a fall through could take it to the next support level of 99.50. The pair is expected to find its first resistance at 103.98, and a rise through could take it to the next resistance level of 105.00.

Moving ahead, Japan’s industrial production data for May, due to release in the early hours tomorrow, will be on investor’s radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.