For the 24 hours to 23:00 GMT, the USD slightly rose against the JPY and closed at 111.52.

In the Asian session, at GMT0300, the pair is trading at 111.52, with the USD trading flat against the JPY from yesterday’s close.

Overnight data indicated that Japan’s adjusted merchandise trade surplus expanded less-than-anticipated to ¥367.3 billion in August, following a revised surplus of ¥363.1 billion in the previous month, while markets were anticipating the country’s adjusted merchandise trade surplus to rise to ¥404.7 billion.

Further, the nation’s exports surged at its fastest pace in nearly four years, after it climbed more-than-anticipated by 18.1% on an annual basis in August, compared to a rise of 13.4% in the prior month. Also, the nation’s imports rose more-than-expected by 15.2% YoY in August, after recording a rise of 16.3% in the previous month.

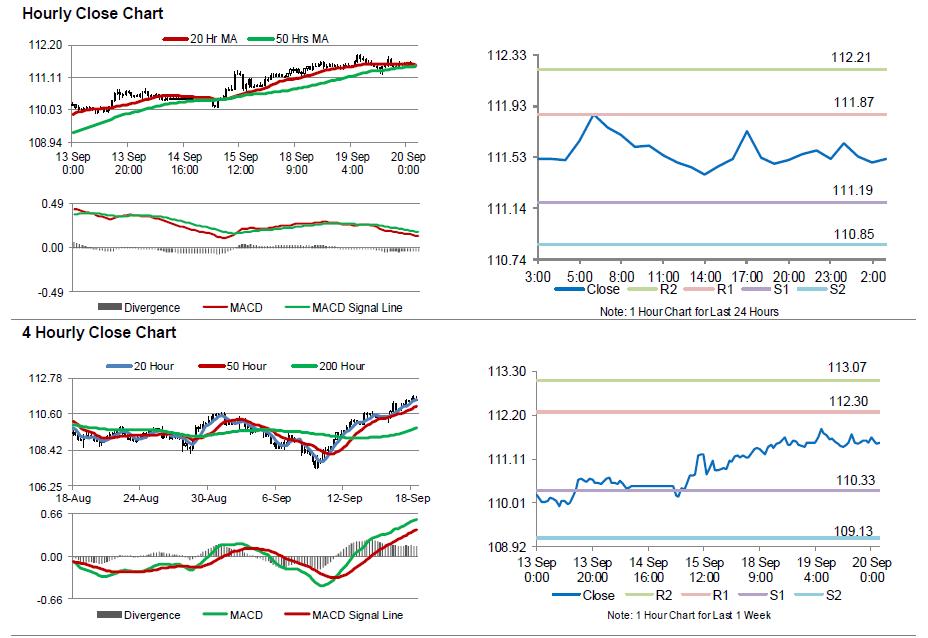

The pair is expected to find support at 111.19, and a fall through could take it to the next support level of 110.85. The pair is expected to find its first resistance at 111.87, and a rise through could take it to the next resistance level of 112.21.

Moving ahead, investors will focus on the Bank of Japan’s (BoJ) monetary policy meeting, scheduled tomorrow.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.